As we know Cryptocurrency is the biggest revolution in the modern financial markets. It has introduced many digital assets with the best possible use case that has captured the interest of investors worldwide. Coin MarketCap is one of the most advanced tools for navigating and analyzing this volatile market, This is the leading platform providing essential data and insights on cryptocurrencies. This blog aims to explore

Table of Contents

What is Coin MarketCap?

Coin MarketCap is a website offering considerable information on the cryptocurrencies market, Established by Brandon Chez in 2013. Coin Marketcap not only provides data according to the Market capitalization(i-e Market capitalization of the cryptoasset is calculated by multiplying the existing reference price of the cryptoasset by the current circulating supply) of cryptocurrencies but it has also developed itself to such an extent that it has become the one-click resource for tracking performance, prices, and rankings of cryptocurrencies by marketcap. The platform aggregates data from several exchanges to provide real-time updates on thousands of digital assets i-e coins by marketcap.

How to use Coin MarketCap: Accessing Information

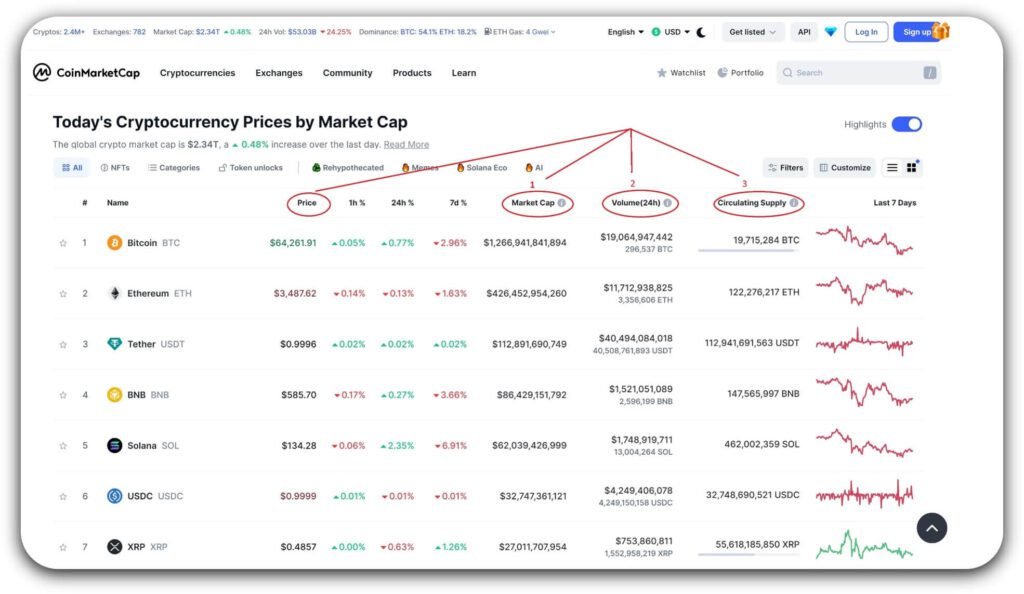

CoinMarketCap provides real-time data on cryptocurrency prices, market capitalization, trading volume, circulating supply, and more. Users can view this data for individual cryptocurrencies as well as compare different assets.

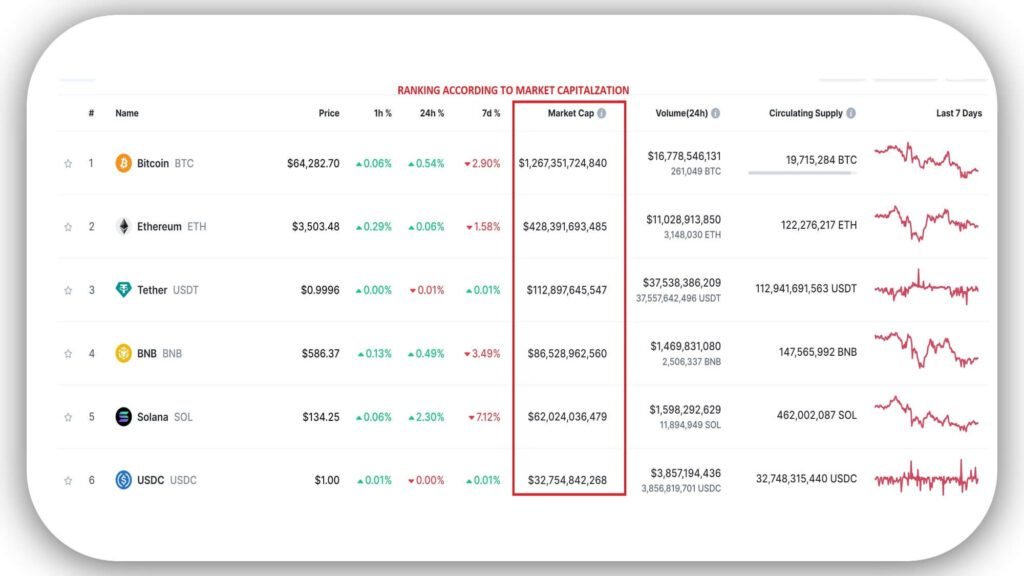

Market Capitalization:

The total market value of a cryptocurrency’s circulating supply. In other words, the proportion of total assets readily available for trading is known as market cap. It can be calculated according to the following formula.

Market Cap = Current Price x Circulating Supply.

Trading Volume:

The total amount of a specific cryptocurrency that has been bought and sold over the last 24 hours is known as the 24-hour trading volume.

The volume for each market pair is calculated by taking the 24-hour volume reported directly from the exchange in quote units for example for Bitcoin it is BTC, and converting it to US Dollars using CoinMarketCap’s existing reference prices by multiplying it with the current price.

Circulating Supply:

We can explain that the number of coins that are part of public holdings and the currently available assets in the market is known as circulating supply. If you didn’t get it here’s a detailed explanation as follow,

The digital assets that are locked (via smart contracts or legal contracts) i.e., investor’s holding of digital assets, and not available to the public

The reserved assets for the project’s ecosystem for its growth such as marketing i-e airdrops,

Assets that are allocated for Staking in master nodes.

Assets owned by project team members or dominant ecosystem participants. These holdings can represent a considerable portion of the total supply which can affect the main supply.

Rankings:

Ranking of cryptocurrencies by market cap is according to their market capitalization, which provides the most convenient way to see the most trending valuable assets in the market. It helps investors, traders, and analysts identify the top cryptocurrencies their trends, and investor’s interests to make decisions accordingly.

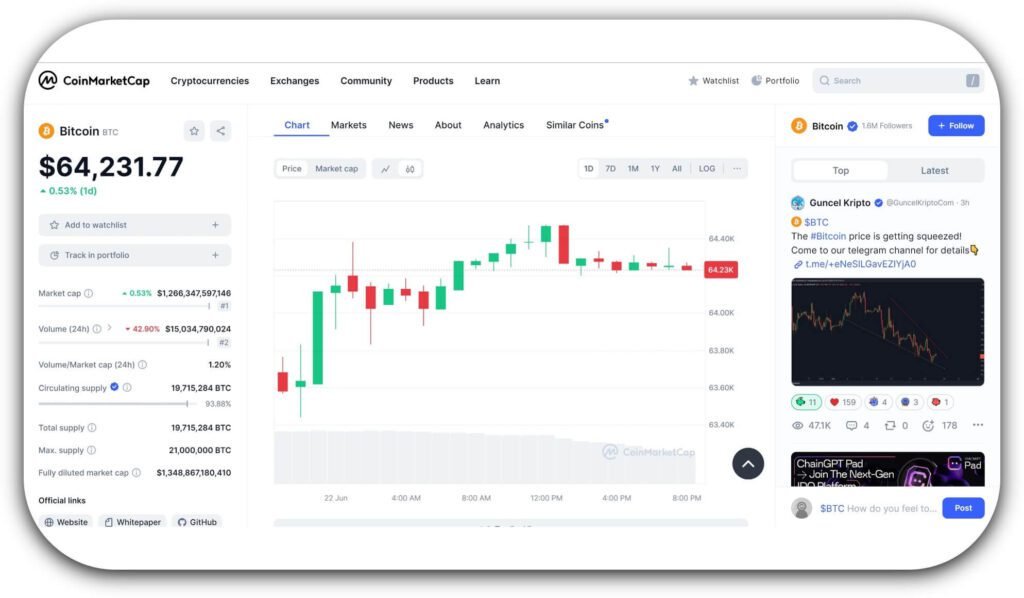

Historical Data:

Coin MarketCap provides the historical data for every listed cryptocurrency which is crucial for technical analysis, such as

Pricing: Pricing is depicted on price charts. Price charts are the graphical representation of the Price on the X-axis and Time on the Y-axis. Investors, traders, and analysts use Price charts for technical analysis to identify trends and entry or exit points in trading, In simple words to make money from these analyses.

Like in this picture, the Bitcoin Price is $64231 on June 22, 2024.

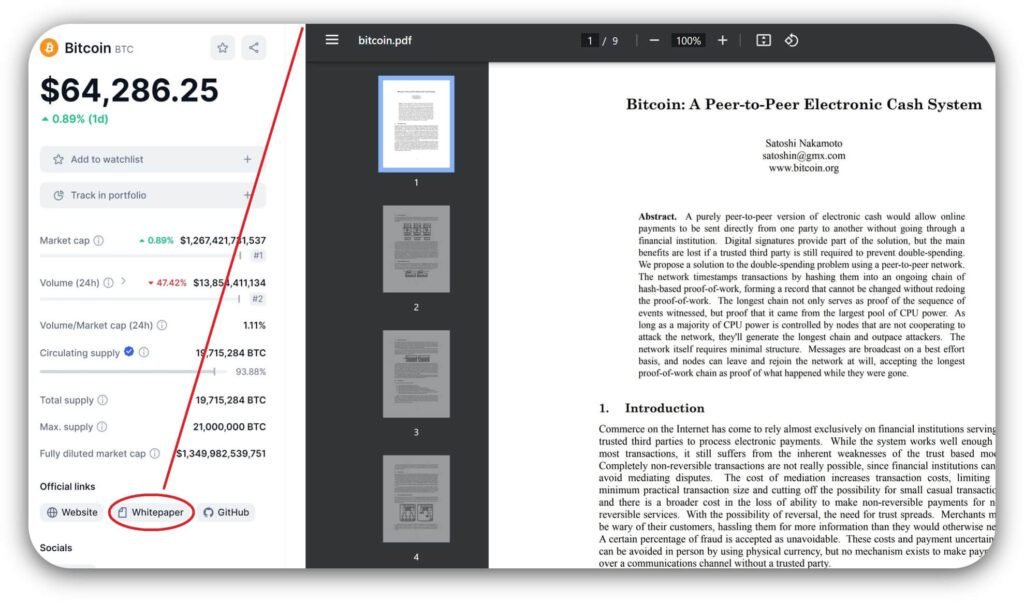

Whitepaper:

It is a document published by the developers of a new cryptocurrency or blockchain project. It outlines the technical details of how it is unique from other projects, its use case(i-e Contribution to the community), underlying technology e-g, ( Artificial intelligence, real-world assets or gaming, etc..), features, and tokenomics (i.e. distribution, supply, economics, value, and utility).

The whitepaper is very important for long-term investors as it helps them to understand the roadmap for the project, its authenticity, and its goals and functionality. The whitepaper that contains all the above-mentioned best attributes, attracts more investment during the initial stages of development.

Following is the picture of bitcoin whitepaper

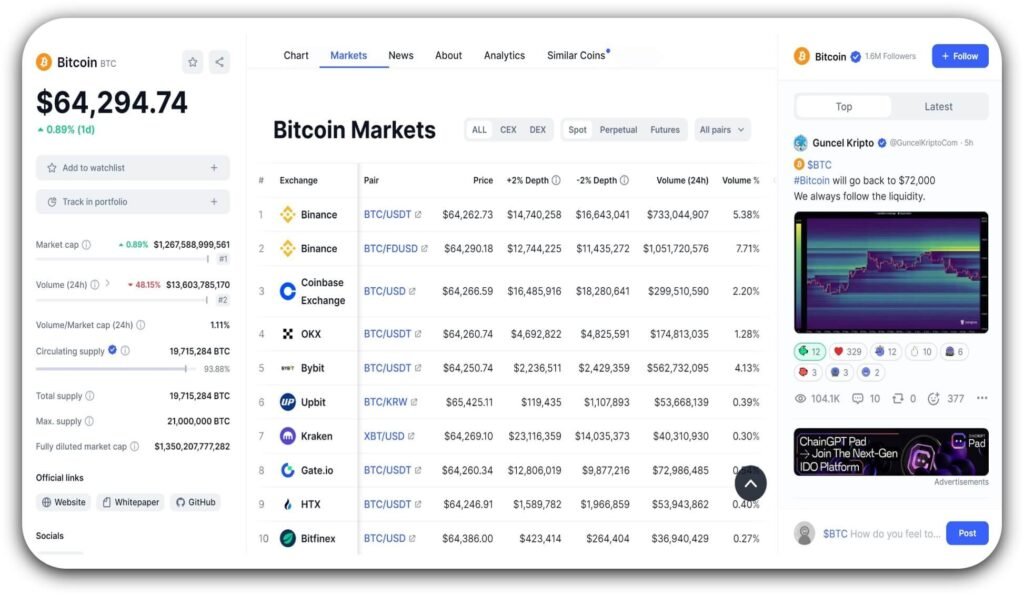

Cryptocurrency Markets:

In this category, cryptocurrencies are listed on different exchanges along with their trading pairs, volumes, and liquidity. The details provided in this category facilitate the investors to select the most suitable exchanges based on their trading requirements and available capital. Thanks to the rankings by coin marketcap.

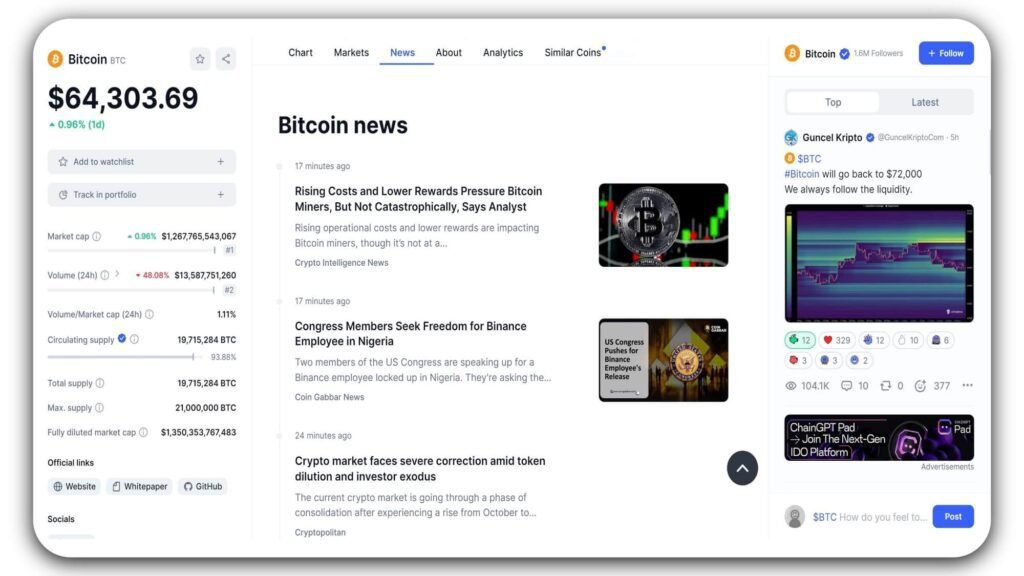

Crypto Market News:

As we know this digital market is a volatile market, unlike other markets it has a strong impact of news on its price hence staying updated with the latest news is a need of an hour. Coin MarketCap gathers news on market developments, and other significant events from authentic sources and provides it on time.

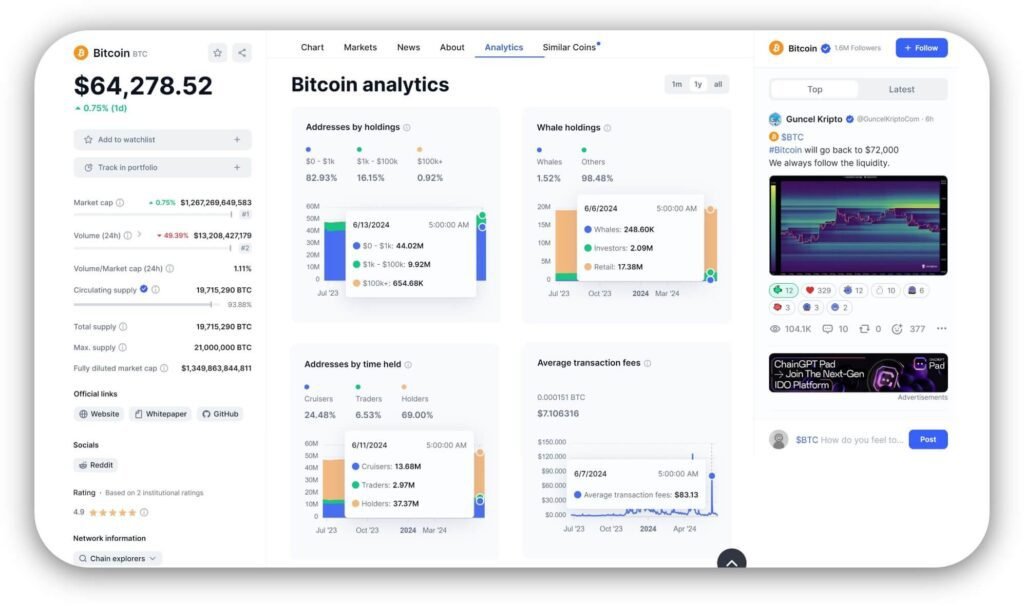

Analytics:

This analysis typically provides key insights into the wealth distribution within the cryptocurrency market. And the transaction fees which are very significant to watch while trading.

Address by holdings:

It usually depicts the breakdown of cryptocurrency addresses based on the amount of cryptocurrency they hold. This chart categorized the investors according to their investments i-e Blue $0-$1K; Green $1K-$100K; Yellow $100+. It means people with portfolios of $0-$1K hold an 82% share in the market they are usually retail traders, people with portfolios of $1K-$100K hold a 16% share in the market they are usually investors or long-term traders, people with portfolios of $100K+ are the institutional investors also known as “whales” in the market.

Whale holdings:

The small number of large capital holders, are known as “whales.” They own a serious portion of a cryptocurrency’s total supply.

These whales can significantly impact the market from their buying or selling as it creates high demand and supply, This impact is the cause of changing market sentiment and liquidity grab.

Coin MarketCap, provides access to such valuable information as analytics and tracking of whale addresses.

Access to such information is very useful for users to keep their valuable digital assets safe. These tools help users to monitor the movements of large holders and assess potential market impacts.

Addresses by time held:

It classifies different wallet or exchange addresses that usually hold that specific cryptocurrency at that time.

This metric can provide insights into the behavior and intentions of different types of holders i.e. cruisers: short-term holders or retail traders, Traders: Institutional traders, or medium-term holders, and Holders: Long-term investors, who hold cryptocurrency for a longer period.

In other words, this provides a fair perception of the market trend which is very much useful for the users to make decisions regarding investments because from this data users can easily watch the movement of digital assets from different wallet addresses so that they can predict from it that market would remain in a continuation, range or liquidity phase.

Average Transaction Fee:

It is defined as the average cost per transaction.

To explain more briefly, Whenever a user takes a position in the market by buying or selling the cryptocurrency he would have to pay the cost of that transaction.

That transaction is confirmed by miners on a block in a blockchain network in return they would get an incentive for feeding that data into the next block of the blockchain.

Average transaction fees affect the cost of using a cryptocurrency for transactions. High fees can make a cryptocurrency less attractive for everyday use.

Coin marketcap provides the best data on transaction fees so that it becomes handy for users to make informed decisions.

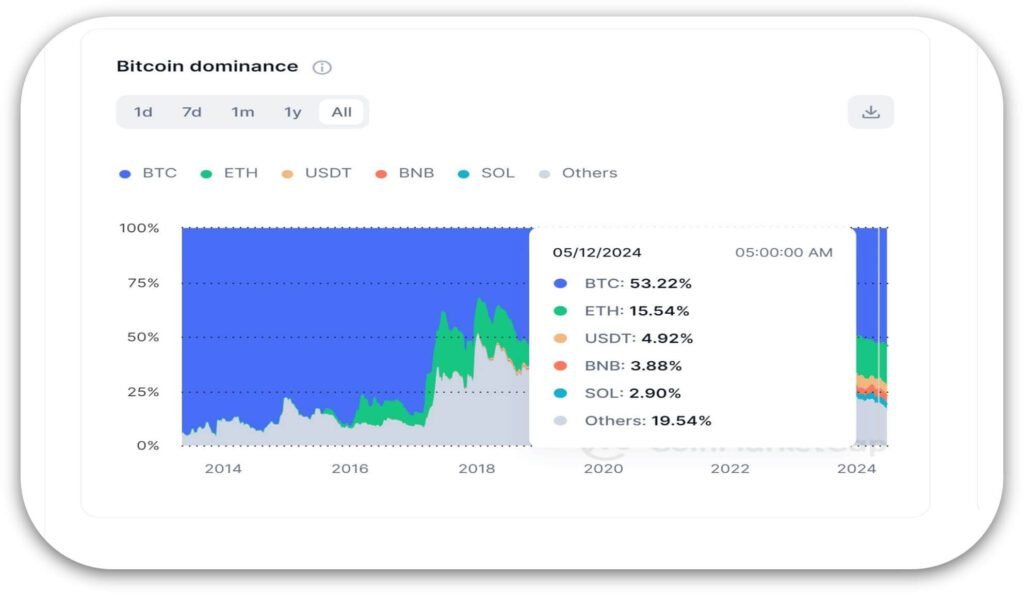

Bitcoin Dominance:

Bitcoin dominance is the percentage of the total cryptocurrency market capitalization that is held by Bitcoin. It measures Bitcoin’s relative strength compared to other cryptocurrencies.

Let me explain it through the following chart

For example, let us assume today’s Market capitalization is 1 trillion dollars and BTC Dominance is 53.22%, which means Bitcoin’s market capitalization is 53 million dollars, and Ethereum’s market capitalization is 15.53 million dollars.

BTC dominance is often used to perceive the market’s preference for Bitcoin over other cryptocurrencies and can indicate market trends, for example in an Uptrend or Bullish market if BTC dominance decreases, Interest in altcoin prices increases which would increase prices of the altcoin.

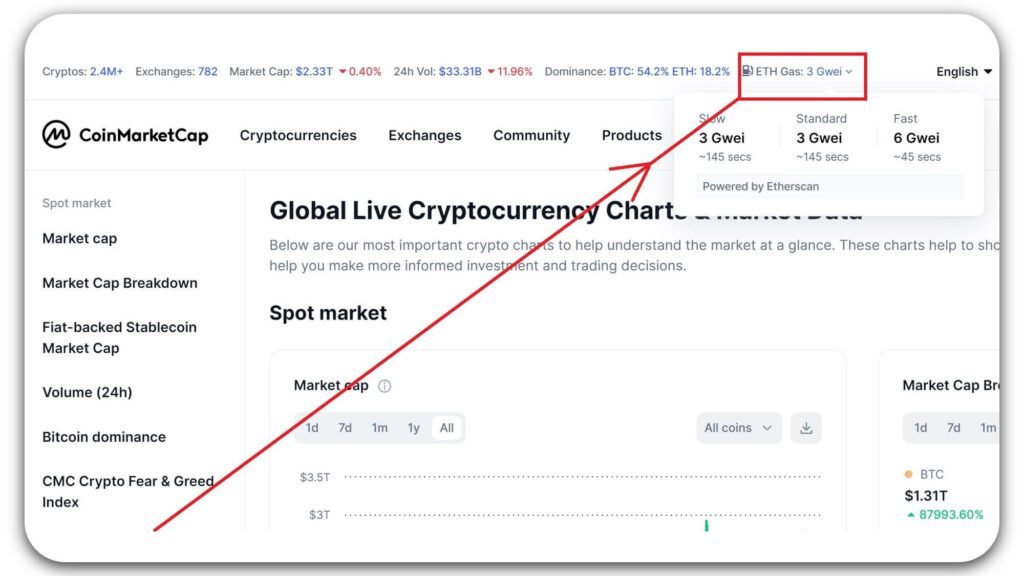

Ethereum Gas:

ETH gas is the unit that measures the computational effort required to execute operations on the Ethereum blockchain. Gas is used to pay for transactions and smart contract executions.

The cost of gas is denoted in “gwei,” For better understanding take this example question “ What would be the transaction fee if the ETH gas is 3 Gwei ETH gas limit is 21000 that is standard for simple transfer?”

following is the formula for calculating transaction fees from gas fee

Transaction Fee=Gas Limit×Gas Price

Where:

- Gas Limit is the maximum amount of gas units used for the transaction.

- Gas Price is the amount paid per gas unit, usually measured in gwei.

1 gwei is equal to 0.000000001 ETH.

Let’s say the gas limit for a transaction is 21,000 (a common value for a simple ETH transfer).

If the gas price is 3 gwei, the transaction fee would be calculated as follows:

Transaction Fee = 21,000 x 3gwei

Transaction Fee = 21,000 × 3 × 0.000000001ETH

Transaction Fee = 0.000063ETH

if the gas price is 3 gwei, the transaction fee would be 0.000063 ETH.

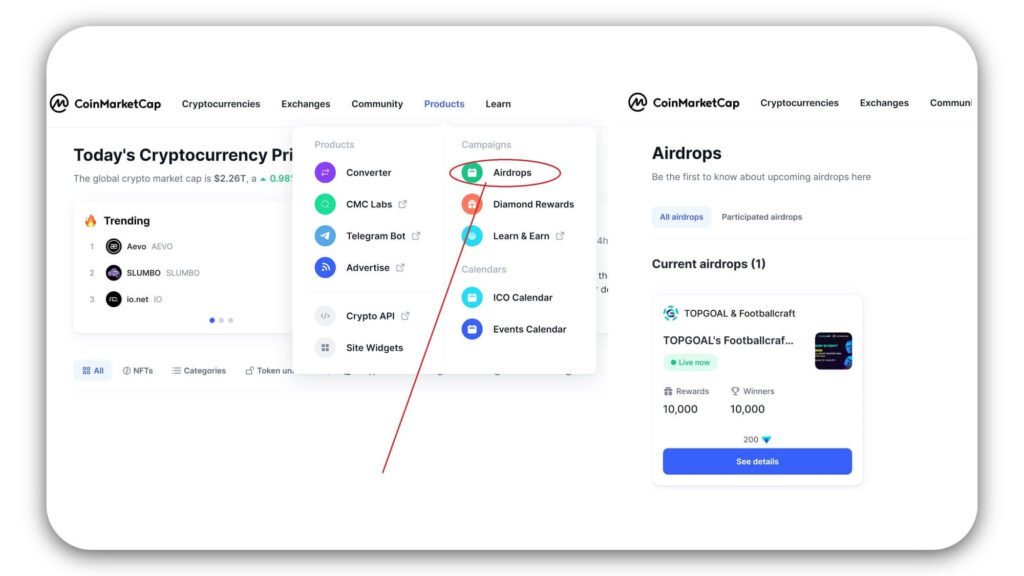

Airdrop crypto:

That is another very cool feature of the coin marketcap, say if you don’t have any investment for trading and investment then airdrop might get you the investment you need to start, People have earned millions of dollars from airdrops.

What is Airdrop? New project before their launch distributing tokens to many wallet addresses for free or as part of a marketing and promotional campaign raising awareness about a new cryptocurrency project and generating interest.

Airdrops can reward existing users or community members for their loyalty or participation in the ecosystem.

Thanks to Coin MarketCap can give you access to know about the upcoming airdrop projects so that you can be a part of it and earn free money. The only investment required from you is your time.

Importance of Coin MarketCap?

- Precise data: Coin MarketCap provides unbiased and accurate data, this transparency in the data facilitates the user to make informed decisions. “Misinformation is worse than no information,” said Johnathon N Stea

- Informed Decision-Making: The right information at the right time is perfect for a user to make the best decision. Coin MarketCap provides access to real-time data and comprehensive analytics that enables investors to make informed decisions. Whether you are a professional trader or a retail investor, the information supplied by Coin MarketCap can rapidly improve your trading profitability.

- In-depth Analysis: The platform’s extensive historical data and analytical tools allow for in-depth market analysis. This can be particularly beneficial for technical analysts and those interested in understanding market trends and patterns.

Conclusion

In this modern era, the one with instant access to the data is way ahead of time, allowing him to make more accurate decisions and to get the best out of everything. It won’t be wrong to say that success is directly proportional to decisions with accurate updated information. Coin MarketCap is the most worthwhile resource, providing priceless information and tools to help users perceive and understand the complex crypto infrastructure.

Whether you are tracking the latest prices, conducting market analysis, or simply seeking to learn more about digital assets, CapMarketCoin is your comprehensive guide to the cryptocurrency markets.

By utilizing the data and insights provided by Coin MarketCap, you can enhance your market understanding, make more accurate investment decisions, and maximize your chances of success in the World of cryptocurrencies.

Thank you for taking the time to read my blog post. I hope you found it informative and engaging. I would love to hear your thoughts and feedback!

Do you have any insights or experiences to share? Please leave your comments below. Your response is highly appreciated.

FAQs

1: What is Coin MarketCap?

Coin MarketCap is a leading website that provides extensive data and insights into the cryptocurrency market. Established by Brandon Chez in 2013, it tracks cryptocurrencies’ performance, prices, and rankings by market capitalization.

2. How can I access market data on Coin MarketCap?

You can access real-time data on cryptocurrency prices, market capitalization, trading volume, and circulating supply for individual cryptocurrencies and compare different assets. The link provides step by step guide to learning different aspects of coin marketcap.

3. What is Market Cap, and how to calculate it?

Market capitalization is the total market value of a cryptocurrency’s circulating supply. It is calculated using the formula: Market Cap = Current Price x Circulating Supply.

4. Where we can find the Market cap of different cryptocurrencies?

You can find market capitalization, real-time data on cryptocurrency prices, trading volume, and circulating supply for individual cryptocurrencies, as well as comparing different assets in coin marketcap.com

5. What is a whitepaper, and why is it important?

A whitepaper is a document providing cryptocurrency’s technical details, use case, underlying technology, and tokenomics. It helps long-term investors understand the project’s roadmap, authenticity, and goals.

6. What kind of analytics does Coin MarketCap offer?

Coin MarketCap offers insights into wealth distribution, transaction fees, address holdings by portfolio size, whale holdings, and addresses by time held, helping users assess market trends and impacts.

7. How do I calculate Ethereum gas fees?

Ethereum gas fees are calculated using the formula: Transaction Fee = Gas Limit x Gas Price. For example, with a gas limit of 21,000 and a gas price of 3 gwei, the transaction fee would be 0.000063 ETH. For a detailed explanation read the complete blog post.

8. What is Bitcoin dominance?

Bitcoin dominance is the percentage of the total Market Cap held by Bitcoin in the crypto market. It indicates Bitcoin’s relative strength compared to other cryptocurrencies.

9. What is an airdrop in cryptocurrency?

An airdrop is a distribution of free tokens to multiple wallet addresses as part of a promotional campaign for a new cryptocurrency project. Coin MarketCap provides information on upcoming airdrops, allowing users to participate and earn free tokens.

10. Where to find Upcoming airdrops in cryptocurrency?

You can Upcoming airdrops on the most authentic website coin marketcap.com, Please read the complete blog post to understand how to use coin marketcap to find Upcoming airdrops.