This blog aims to provide in-depth analysis and comparisons of their features to assist you in selecting the best exchange for crypto. After reading this blog you will be able to choose the cryptocurrency exchange that best meets your needs.

What distinguishes this blog? While most blogs provide general information about exchanges, this guide differentiates by comparing specific attributes. This blog provides detailed explanations of the attributes used for ranking an exchange not readily available elsewhere, and why should you consider these attributes while choosing an exchange for crypto.

Table of Contents

Understanding Crypto Exchange:

A cryptocurrency exchange is a platform where you can buy, sell, and trade cryptocurrencies. This flexibility makes it easier to convert cryptocurrencies into other digital assets or traditional fiat currencies like the US dollar. dollars or euros. They provide a marketplace where buyers and sellers can interact, and the exchange acts as an intermediary shaped by their orders.

Types of crypto exchange:

It is important to know the types of crypto exchange before buying, selling, or trading an asset because there are pros and cons of each type of exchange, it is better to have some good information about types of exchange for crypto. There are two types of crypto exchange.

Centralized (CEX):

Centralized exchanges (CEX) are cryptocurrency trading platforms with a centralized authority or intermediary. CEXs typically require users to create accounts and run authentication programs to comply with Know Your Customer (KYC) regulatory requirements. This exchange manages order books, matches buying and selling orders, and performs transactions for you, it also provides user-friendly interfaces and security features.

Decentralized (DEX):

This crypto exchange enables interactive trading of cryptocurrencies without relying on a central authority.DEX uses Blockchain technology and smart contracts to facilitate direct transactions between users, DEX increases transparency and decreases the risk of manipulation.

Some of these exchanges are non KYC crypto exchanges, they do not require KYC for their usage.

This type of crypto exchange often experiences challenges in terms of liquidity and user experience. The risk associated with smart contracts, Legal uncertainty, and limited asset support is also a concern.

Characteristics of a crypto exchange:

An exchange for crypto is further categorized into a spot exchange and a derivatives exchange which are two distinct types of cryptocurrency trading platforms:

Spot Exchange:

This is an exchange where the transaction is completed at the current market price, which means you can buy or sell and acquire the real asset also known as the spot market, you can buy the spot market and acquire any property immediately. In other words, you pay money in real time when the transaction is completed.

Derivatives Exchange:

In this type of crypto exchange, you trade financial instruments (derivatives) whose value is derived from the value of an underlying asset such as cryptocurrency. They do not own the underlying cryptocurrency but consider its price movement.

This includes futures markets, swaps, options, and other complex financial instruments. You can use Leverage, which allows you to manage larger positions with less capital. Leverage comes with interest incurred on it.

.

Factors to Consider When Choosing an Exchange for Crypto:

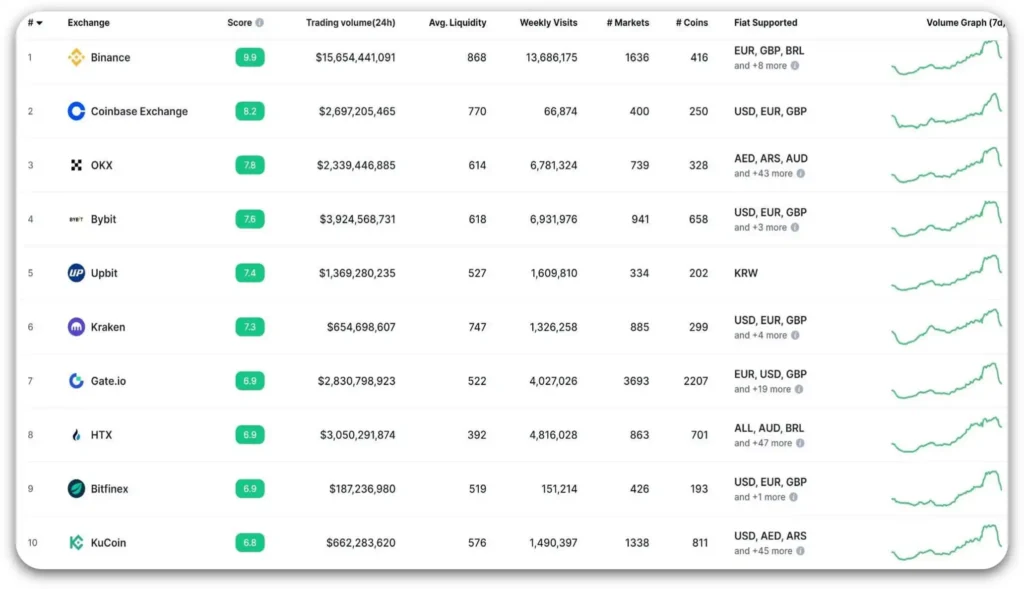

Based on the visual of the spot market as shown in the picture below, here is the explanation of the critical factors to evaluate, this will provide you with a broader perspective when selecting one of the best exchanges for cryptocurrency. Courtesy to coinmarketcap.com for giving that data to us.

If you want to learn more about CoinmarketCap.com please check out our blog on CoinmarketCap.com

Trading volume(24h):

It is the total amount of cryptocurrency traded on an exchange within 24 hours. This metric is used to measure a crypto exchange’s liquidity and activity level.

Whereas Higher trading volumes generally indicate greater liquidity in crypto exchange, We can deduce that more buyers and sellers are actively involved in trading on this crypto exchange.

How can Trading Volume(24h) be the metric for choosing the best crypto exchange?

Top crypto exchanges with High trading volumes can absorb big buy and sell orders without a drastic impact on market price which often influences cryptocurrency prices more.

Best exchanges for cryptocurrency have a high trading volume that indicates they are highly reputable and trusted by many traders, which can be seen as a vote of confidence in the platform’s reliability.

Traders and investors use trading volume (24h) to compare and choose one of the top crypto exchanges offering liquidity and trading activity that best suits their needs.

Avg. Liquidity:

There are many definitions of liquidity but in simple words, it is the ability to buy or sell assets on an exchange without causing significant price movements known as Liquidity in the exchange for crypto. It is influenced by trading volume, order book depth, and the number of active traders.

How do you use the average liquidity metric to choose an exchange for crypto?

The liquidity number on exchanges shows how much trading activity occurs on the platform and how easily assets can be bought or sold without affecting their price drastically. We will prefer to choose crypto exchanges with higher liquidity numbers because they provide better opportunities for executing trades quickly and at desired prices.

If the exchange for crypto has high liquidity, it reduces the volatility and spreads, making the market more predictable because the price is stable large trades have a minimal effect on the price of an asset,

You can enjoy lower transaction costs because of lower spread (bid-ask) due to High liquidity. In other words, you pay a lower transaction fee due to small differences between buy and sell prices.

Weekly Visits: (Exchange Traffic)

We will take it as website traffic (exchange Traffic) which is the number of visitors that a crypto exchange receives within a specific seven-day period, Simply how many different individuals or devices access the platform within a given week. It is also an attribute of one of the best exchanges for crypto.

How can it provide valuable insights when choosing a crypto exchange?

Consistent high traffic means high trust, legitimacy, and a good reputation. It shows that more users visit and use the crypto exchange regularly and it is well-known, trusted, and has a strong user base within the cryptocurrency community.

The top crypto exchanges with high traffic often invest more in user interface, customer support, and security features. This exchange for crypto with such an attribute can provide a good user experience and has fewer technical issues with good troubleshooting.

Top crypto exchanges with high traffic can have a greater influence on cryptocurrency prices. Crypto Exchange with higher traffic volume can attract more institutional investors and traders, as they have greater influence on prices which leads to higher market liquidity and price stability.

Number of Markets (#Markets):

If you want to spread your portfolio among different assets you need a crypto exchange with a larger number of markets that provide more trading pairs, which enables you to invest and trade a broader selection of cryptocurrencies and fiat currencies.

How can it be useful in choosing an exchange for crypto?

See it is based on how you want to invest in cryptocurrency, it provides the ease of access to various cryptocurrencies based on new narratives which will ultimately benefit you by diversifying your investment and taking advantage of different market narratives.

Fiat Supported:

An exchange for crypto that directly transacts US dollars USD, Euro EUR, Pound GBP, or any other fiat currency is known as a fiat-supported exchange. It provides the facility to deposit, withdraw, and trade cryptocurrencies directly using fiat money to and from your bank accounts, without converting it to cryptocurrencies such as Bitcoin or Ethereum on a different platform.

Why this feature is valuable for choosing the best crypto exchange?

Crypto Exchanges that support fiat Deposit and withdrawal processes are convenient for beginners and experienced traders.

Additionally, this type of exchange for crypto often adheres to regulatory standards and compliance requirements, which adds confidence in the security and legitimacy of the exchange.

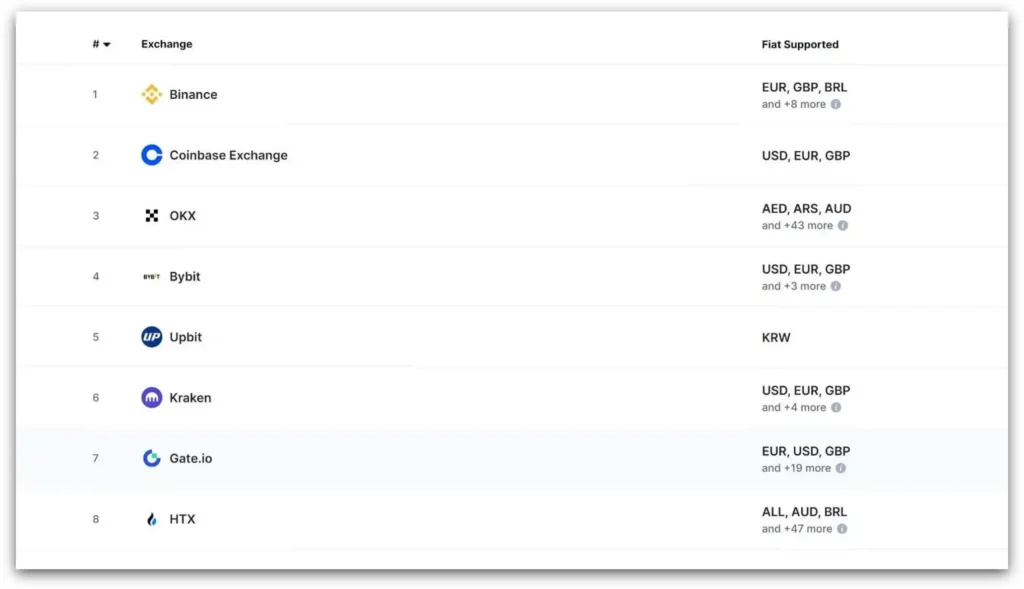

We know that more steps involved in transactions involve more fees with every step, Crypto exchange with such a feature would decrease certain steps of first purchasing the popular currency on another platform and then converting it to your desired currency. The image above shows that Binance supports EUR, GBP, BRL, and +8 more fiat currencies, similarly, OKX supports AED, ARS, AUD, and +43 more fiat currencies.

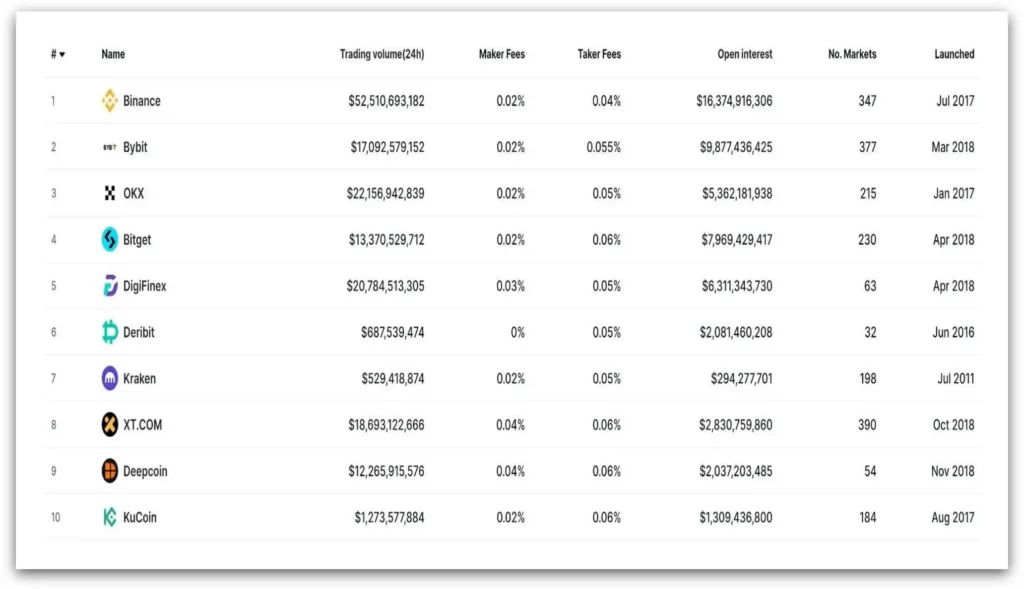

Following is the picture of the ranking showing the Derivatives market according to the features, let us explain these features to help you choose the best exchanges for cryptocurrency.

Fees and Costs: (Maker Fee and Taker Fee):

Maker Fee

If you place a limit order in the market you are adding liquidity to the market, you are considered a Maker, and the fee charged to you is known as the maker fee.

A limit order is an order placed by you that doesn’t execute immediately, Suppose you place an order at a higher price than the market price it doesn’t get filled right away until the price comes to your order price specifically.

Maker fees are usually less than taker fees to encourage traders and investors to add liquidity to the market by placing an order that may executed later.

It may differ between exchanges and depend on your trading volume or membership level.

Taker Fee:

If you place a market order you are removing liquidity from the market, you are considered a Taker, and the fee charged to you is known as the Taker fee. The Market order is an order that is executed right away as you place an order at a real-time market price.

The crypto exchange usually charges the taker fee higher than the maker fee because the takers are removing liquidity from the market. These fees can vary between exchanges.

Withdrawal Fees:

Exchanges often charge fees when users withdraw cryptocurrencies or fiat currencies from their exchange wallets to external wallets or bank accounts.

These fees can vary based on the cryptocurrency being withdrawn and the network congestion at the Withdrawal time.

Deposit Fees:

Some exchanges may charge fees for depositing funds into the exchange platform, particularly for fiat currency deposits.

The fees can vary depending on the deposit method (e.g., bank transfer, credit card, or other payment methods).

Inactivity Fees:

If your account stays dormant or inactive for an extended period, few crypto exchanges will impose an inactivity fee on you, claiming it covers the cost of maintaining your account or encouraging you to trade.

I do not know how this feature encourages people to trade, conversely it will discourage people from using that crypto exchange.

Why is it important to consider a fee structure before choosing a crypto exchange?

Cryptocurrency traders and investors must carefully review and understand an exchange for crypto’s fee schedule and policies before trading because the total cost of using the platform can affect overall profitability and trading strategy. Fee structures can vary significantly between exchanges.

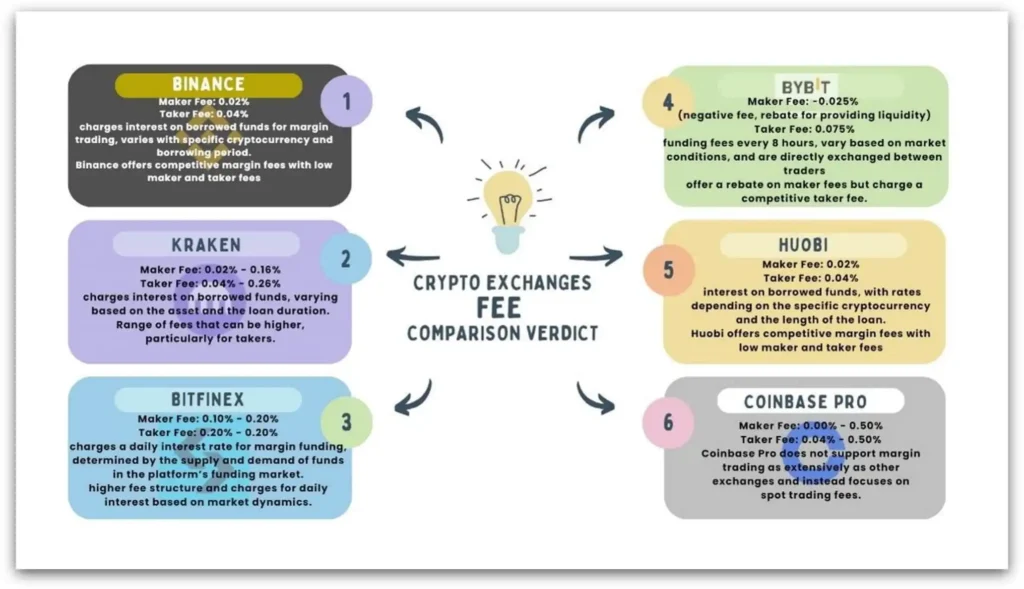

Binance, Kraken, and KuCoin generally provide competitive fee structures,

Bitfinex and Gemini zero maker fee, which can benefit high-volume traders.

Here is a small pick from some of the best exchanges based on fee schedule by viewing the pictures above

Open interest:

The total number of derivative contracts that include futures contracts yet to be filled is known as open interest in an exchange for crypto. In other words, the total amount of money or assets market participants have committed to the market through these contracts let’s take an example of bitcoin through the figure above,

Open interest rises when market participants create new contracts by opening positions, either buying long or selling short, it also indicates the influx of money in exchange for crypto. High open interest indicates strong trust and reputation of institutions in a crypto exchange.

How does open interest determine the repute of crypto exchange?

Let’s take an example of Binance and Kraken through the above picture from coinmarketcap.com, Binance has an open interest of $16,374,916,306, indicating that traders have placed orders of this amount that are yet to be filled. Whereas kraken’ open interest is about $294,277,701 which is way less than that of Binance, which means Institutions, banks, whales and traders trust Binance more to put such a large amount in an exchange making Binance more trustworthy as compared to Kraken.

High open interest means more trust in the exchange for crypto of traders and institutions. You must prefer such exchanges which are entrusted by banks institutions and big traders.

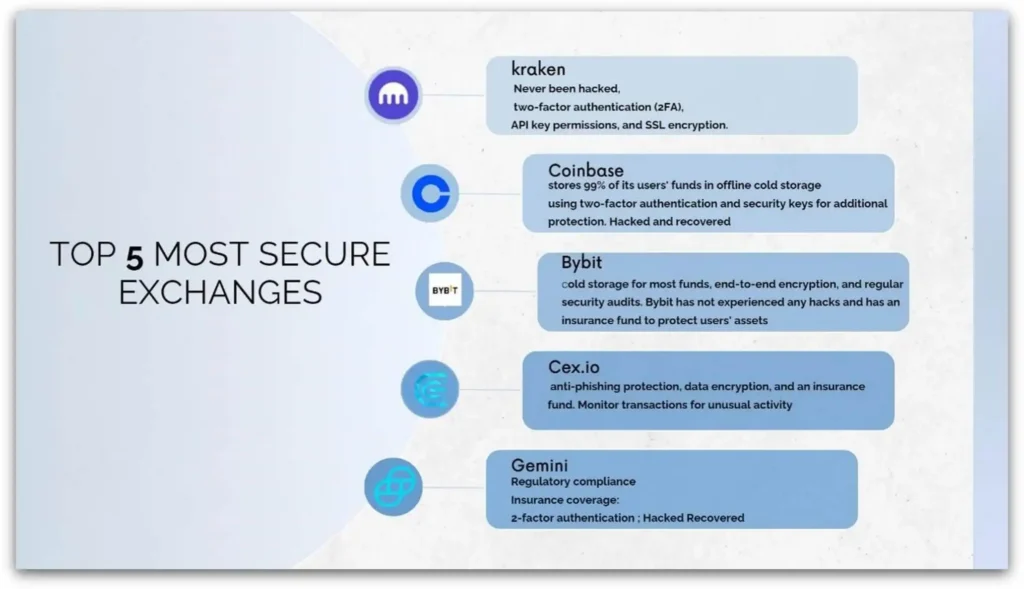

Security:

Security is the foremost pillar in choosing the best exchanges for cryptocurrency due to the risks associated with digital currencies. Cryptocurrencies are particularly vulnerable to cyberattacks, exchange hacks, and fraudulent activities.

What are the factors to check in crypto exchange before choosing it?

The crypto exchange supports two-factor authentication 2FA, preferably using authenticators like Google Authenticator or hardware-based options like YubiKey. It adds an extra layer of security beyond just a password.

Before choosing an exchange for a crypto check for Regulatory compliance which are licenses or certifications, and compliance with KYC (Know Your Customer) and AML (Anti-Money Laundering) policies. For choosing the best exchanges for crypto always ensure that it adheres to legal standards and regulations, which adds a layer of accountability.

Research any past security incidents and how the exchange handled them. The best exchanges for cryptocurrency typically absorb losses rather than passing them on to users. User reviews and expert analyses can provide insights.

Top crypto exchanges possess the availability of 24/7 customer support and a transparent incident response policy. A quick and effective response to security incidents is vital.

Best exchanges for crypto support for multi-signature wallets, especially for large withdrawals. It requires multiple private keys to authorize a transaction, enhancing security.

You must take security as a primary concern for choosing top crypto exchanges, which implement rigorous measures to protect users’ assets.

User Interface and Experience

User interface (UI) is the layout of a trading dashboard on a crypto exchange, including how the buy/sell buttons are positioned, the color scheme, and the design of charts and graphs.

User experience (UX) is the ease with which a user can create an account, navigate the trading platform, execute a trade, and find support when needed. This includes the overall satisfaction and efficiency of using the exchange.

Why is it an important feature for choosing an exchange for crypto?

Considering the user interface (UI) and overall user experience (UX) are important when choosing the best exchanges for crypto. A well-designed interface can make trading easier, more efficient, and less stressful, especially for beginners.

Performance and Speed are critical in trading so the exchange platform should load quickly and efficiently handle high traffic volumes without lag. it ensures the platform provides real-time market data and updates, which are crucial for making timely trading decisions. Top crypto exchanges often provide advanced trading tools and features, which are highly beneficial for professional traders.

Check if the exchange offers a mobile app with all the features of the desktop version. This is important for traders who want to manage their investments on the go. If there is no application, the exchange’s website should be mobile-responsive, providing a seamless experience on smartphones and tablets.

Here’s our pick of top exchanges for crypto with the good UIUX.

Regulatory Compliance:

Regulatory compliance for a cryptocurrency exchange refers to the adherence to laws, regulations, and guidelines set forth by governmental and financial regulatory bodies to ensure that the exchange operates legally and ethically. These regulations are designed to protect investors, maintain market integrity, prevent fraud, and mitigate risks associated with money laundering and terrorism financing.

How does Regulatory compliance play a role in choosing the right crypto exchange?

Compliance with regulations helps build trust with users, investors, and partners, demonstrating that the exchange operates transparently and ethically. Ensuring regulatory compliance allows the exchange to operate legally, avoiding fines, penalties, and shutdowns by authorities. Regulated crypto exchanges are more reliable and less prone to shutdowns, ensuring the safety of your invested funds.

Top Exchanges Ranked by Key Attributes Fintech Apps

Here is our list of the best exchanges for crypto, highlighting the top attributes of each. Choose one of the best exchanges for cryptocurrency that meets your requirements.

Coinbase Pro is often recommended as a reliable exchange for crypto due to its strong security measures and user-friendly interface.

Binance has grown to be a leading exchange for crypto, offering a wide range of trading pairs and low fees.

Kraken provides a professional and secure exchange for crypto, suitable for novice and experienced traders.

If you’re looking for a simple and efficient exchange for crypto, Bitstamp is an excellent choice.

Gemini is renowned as a secure and regulated exchange for crypto, ideal for users in the United States.

Many traders choose KuCoin as their preferred exchange for crypto because of its competitive fees and wide range of supported coins.

Bittrex is a well-established exchange for crypto, known for its robust security features and an extensive list of trading pairs.

For those interested in futures trading, OKEX offers a comprehensive exchange for crypto with advanced trading tools.

Huobi Global stands out as a global exchange for crypto, providing multilingual support and diverse payment options.

Gate.io has positioned itself as a versatile exchange for crypto, offering various trading options and a user-friendly interface.

Conclusion:

Navigating the Cryptocurrency world can be daunting, especially when selecting the right exchange. However, after reading this comprehensive guide, you’ll be equipped to make an informed decision based on detailed comparisons and thorough explanations of each exchange’s attributes.

Unlike other resources, this blog stands out by focusing on specific attributes of exchanges, making it easier for you to pinpoint which platform best fits your needs. By exclusively utilizing CoinMarketCap for data analysis, we’ve ensured the reliability and accuracy of our comparisons.

This blog covered attributes such as Trading volume, exchange traffic, security, fee structure, regulations, open interest, and user interface, and how to use them in determining the best exchanges for cryptocurrency accordingly. Also understanding the nuances of different exchanges, from centralized and decentralized platforms to spot and derivatives markets, is crucial as each type offers unique benefits and challenges that must be considered.

This blog has provided the tools and knowledge to compare exchanges based on critical attributes, helping you choose the best platform for your needs. Remember, a well-chosen exchange can significantly impact your trading success and overall experience in the crypto market. Happy trading!

Thank you for taking the time to read our comprehensive guide on choosing the best exchange for crypto! We hope you found the insights and comparisons valuable in making informed trading decisions.

But we don’t want the conversation to end here! Your thoughts and experiences are incredibly important to us.

Share Your Experiences: Have you tried different crypto exchanges? We’d love to hear about your experiences, the good and the bad. Your stories can help others in the community make better choices.

Ask Questions: If there’s anything you’re unsure about or if you have specific questions, don’t hesitate to ask. Our team and community are here to help you navigate the crypto world.

Give Feedback: What did you think of our guide? Is there something we missed, or a topic you’d like us to cover in the future? Your feedback helps us improve and provide content that meets your needs.

Your Voice Matters!

We believe that an engaged community is a strong community. Leave a comment below, or reach out to us on social media. Your insights and feedback are what drives us to create better content for you. Let’s grow and learn together in this exciting world of cryptocurrency!

FAQs

What is a cryptocurrency exchange?

An online platform where users can buy, sell, and trade cryptocurrencies is known as a Cryptocurrency exchange. It acts as an intermediary between buyers and sellers, offering a marketplace for trading digital assets like Bitcoin and Ethereum. Exchanges can also convert cryptocurrencies into fiat currencies such as USD or EUR.

What crypto exchanges are available in new york?

Cryptocurrency exchanges can be categorized into two main types:

Centralized Exchanges (CEX): These exchanges have a central authority that manages trades, requires account creation, and offers user-friendly interfaces with high security.

Decentralized Exchanges (DEX): These exchanges operate without a central authority, using blockchain technology and smart contracts to facilitate direct peer-to-peer trading.

What is the difference between a spot exchange and a derivatives exchange?

Spot Exchange: In a spot exchange, transactions are completed at the current market price, and the asset is delivered immediately.

Derivatives Exchange: Here, you trade financial instruments like futures or options based on the price of cryptocurrencies, without owning the actual asset.

Why is trading volume important when choosing a crypto exchange?

Trading volume reflects an exchange’s liquidity and overall level of trading activity. Higher trading volumes mean greater liquidity, which allows for smoother transactions without significant price changes, making it easier to buy or sell large amounts of cryptocurrency.

How does average liquidity affect my trading experience?

Average liquidity refers to how easily assets can be bought or sold without affecting their price. Exchanges with high liquidity allow for quicker and more cost-effective trades, reducing the risk of price volatility.

Why should I consider the number of markets an exchange offers?

A larger number of markets provides more trading pairs, allowing you to diversify your investments across different cryptocurrencies and fiat currencies. This flexibility can help you take advantage of various market opportunities.

What does it mean if an exchange supports fiat currencies?

Fiat-supported exchanges allow you to deposit, withdraw, and trade cryptocurrencies directly using traditional currencies like USD, EUR, or GBP. This feature is convenient for beginners and ensures compliance with regulatory standards.

How do fees and costs impact my choice of a crypto exchange?

Fees such as maker/taker fees, withdrawal fees, and deposit fees can significantly affect your trading profitability. It’s crucial to grasp an exchange’s fee structure before trading to prevent any unforeseen costs.

What is open interest, and why is it important?

Open interest refers to the total number of active derivative contracts, such as futures, that remain unsettled. High open interest in an exchange indicates strong market confidence and higher trading activity, which can be a sign of the exchange’s reliability.

How can I ensure that a cryptocurrency exchange is secure?

Check if the exchange supports two-factor authentication (2FA), complies with regulatory standards, has a history of handling security incidents well, and offers customer support. Prioritizing security is crucial when selecting a cryptocurrency exchange.

Why is the user interface and experience important in choosing an exchange?

A user-friendly interface and smooth user experience (UX) make it easier to navigate the platform, execute trades, and manage your portfolio. This is particularly important for beginners, who might feel overwhelmed by more complex platforms.

What role does regulatory compliance play in choosing a cryptocurrency exchange?

Regulatory compliance ensures that the exchange operates legally and transparently, protecting your investments. It also reduces the risk of the exchange being shut down or facing legal issues.

Which are the top cryptocurrency exchanges based on specific attributes?

Some top exchanges include:

Coinbase Pro: Known for strong security and a user-friendly interface.

Binance: Provides a broad selection of trading pairs and competitive low fees.

Kraken: Provides professional-grade security and features for both novice and experienced traders.

Gemini: Highly regarded for its regulatory compliance and secure environment, especially in the U.S.

2 thoughts on “How to Choose the Best Exchange For Crypto: A Detailed Attribute-Based Comparison”