Ethereum staking 2025! If you are like me, then you must be bored of hearing stories of pump-and-dump coins that fail faster than I can pronounce decentralized finance.

Instead, you’re here for the good stuff—solid returns, less risk, and a strategy that doesn’t involve checking your portfolio every two seconds like you’re waiting for an Amazon package.

I remember the epic great bull run, the bear markets, the meme coin disaster, and even the FTX disaster. But now? Now I am more focused on making the most of my ETH without much worry. What better way to do that than putting Ethereum at stake?

Table of Contents

Let’s break down Ethereum staking in 2025 in a way that’ll have you grinning, informed, and, hopefully, earning.

What is Ethereum Staking?

Imagine your crypto is at a luxurious spa, soaking up rewards while you kick back. That’s essentially what staking is. In more technical terms:

- You commit a defined sum of Ethereum in order to contribute positively to the stability and functioning of the Ethereum basis.

- And in exchange for your service, you use ethers ETH, the universally accepted form of payment. Governments, businesses, and other entities have presented this technology as a kind of thank-you card from Ethereum with a cash tip attached.

Today, in 2025, staking is an even more sophisticated tool that helps Ethereum enthusiasts (like you!) make passive income while securing the Ethereum 2.0 network. This is not the proof of work that your granddad used to mine with his computers or better yet his calculator. Only some ETH and a calm character.

Why Should You Care About Ethereum Staking 2025?

Honestly, in this unpredictable market, passive income sounds like a dream, doesn’t it? So from staking Ethereum, you will be:

- Earning rewards: That’s like earning money while holding out and not buying crap.

- Supporting the network: Your staked ETH helps keep Ethereum decentralized and secure.

- Being part of the future: Ethereum 2.0 is like that futuristic concept car that finally hit the market, and staking is your VIP pass to ride along.

But There’s a Catch… (Of Course)

Nothing in crypto is 100% rainbows and unicorns. There are risks, too:

- Slashing: Nope, this isn’t about sword fights. Slashing is when a validator (someone who’s staking) behaves badly, like going offline too much. You could lose part of your staked ETH.

- Liquidity: Once your ETH is staked, it’s locked up for a while—no touchy.

- Market Volatility: ETH’s value can also go up, down, or sideways more frequently than a rollercoaster can in a theme park amusement.

- Custodial Risks: Delegate your ETH to a third party. That comes with the territory though, there’s always the danger something like this is going to happen.

How to Stake Ethereum: Your Options in 2025

You no longer have to be a tech wizard to open a position on ETH, thank heavens. Since its inception, the Decentralized Finance (Defi) movement has given so many ways for an individual with 32 ETH or even some fractions to get involved. Let’s explore them:

1. Solo Staking: Go Big or Go Home

For the brave and bold, solo staking is a possibility where you can manage your Validator Node.

- 32 ETH minimum: Yep, no small change. But if you’ve got it, why not use it?

- Tech Savviness: You’ll need to know how to run a validator and maintain it, because if your node goes down, you’re looking at slashing penalties.

- Big Rewards: You’ll pocket the full rewards if you keep things running smoothly.

How to Do It:

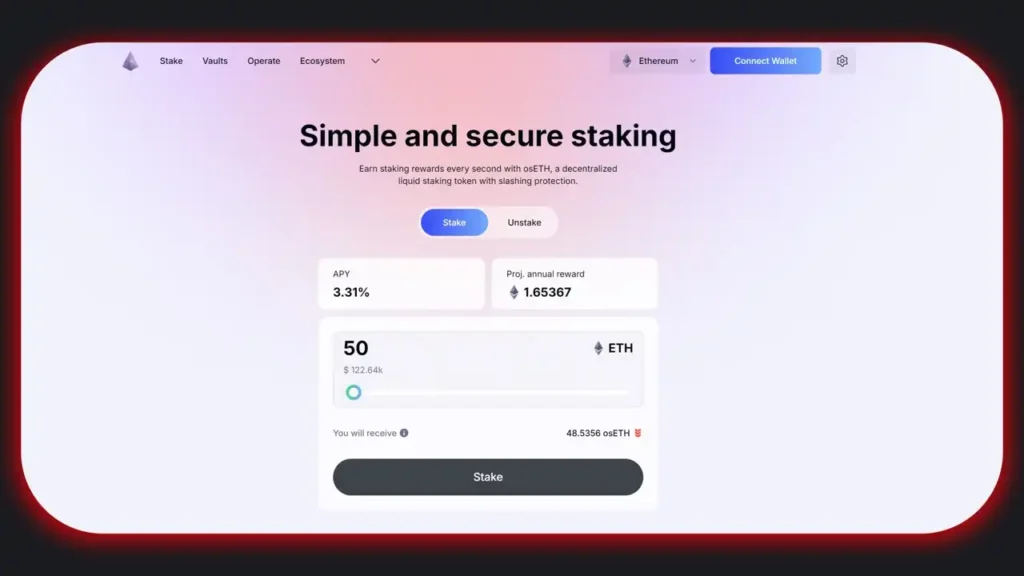

- Install a validator software like StakeWise.

- Deposit your 32 ETH into the staking contract.

- Keep that node online 24/7 to avoid penalties. No pressure!

2. Staking Pools: Teamwork Makes the Dream Work

Well, if you don’t have 32 ETH just lying in your pocket, staking pools are the duplicate. Collect your rewards together with others or stake your Ether!

- No 32 ETH required: The lower barrier to entry.

- No need for technical expertise: Someone else runs the validator; you just kick back.

- Lower rewards: Sure, you won’t earn as much as solo stakers, but you also won’t need to stress about keeping a node alive.

How to Do It:

- Pick a staking pool (think Lido or Rocket Pool).

- Deposit your ETH.

- Some of them even provide you tokens that represent the staked ETH for use in other DeFi operations.

3. Staking Platforms: The Easy Button

I can only imagine that using staking platforms, such as Coinbase, Binance, or Kraken, is as easy as ordering pizza.

- User-friendly: No need to mess with tech.

- Liquidity: There are even selective stir platforms that allow the user to unstake and use the tokens or trade while earning interest.

- Custodial Risks: The only catch is that you are entrusting these platforms with your ETH so make a better one.

How to Do It:

- The first step is to create an account with any of the chosen platforms.

- Then Deposit ETH.

- The 3rd step is to Follow the platform’s instructions, then kick back and watch your ETH earn rewards.

APY in 2025: How Much Can You Earn?

So, what’s the payout looking like these days? Here are some top platforms with their approximate APYs:

- Lido: 3.8%

- Coinbase: 3.7%

- Kraken: 4–7%

- Binance: 3–5%

- Rocket Pool: 3.5–4.5%

Now, remember that APY can change based on network conditions and the amount of ETH staked. So, while these numbers sound sweet, they’re not set in stone.

Ethereum 2.0 Rewards: What to Expect in 2025

Ethereum 2.0 rewards are the icing on the cake when you stake ETH. Thanks to Ethereum’s transition to Proof of Stake, you’re contributing to network security and scalability while pocketing ETH rewards.

But What Are the New Buzzwords to Look For?

I’ve done some digging, and here are a few keywords you might want to keep in your crypto glossary:

- “Best Ethereum staking platforms 2025”

- “Ethereum staking vs. DeFi yield farming“

- “ETH staking for beginners 2025”

- “Top staking pools for Ethereum 2025”

- “How an Ethereum ETF Could Drive a Surge in ETH Price“

These can help you tailor your research and discover even more ways to maximize your ETH holdings.

Read Also: Breaking Down the Coinbase BlackRock News: Bitcoin’s New Custody Reality

Conclusion:

Even if you are still asking yourself if ‘it’s worth it to stake ETH?’ the answer is possibly yes. That stake can offer good passive income once you are willing to accept losses and think in the long term.

Whether you are staking alone or with others, the Ethereum staking landscape in 2025 seems to provide enough options to smart contractors willing to stake, but contribute to the ecosystem in other ways.

Go out now, put down that ETH, and allow your crypto to do the job. But hey, you know what? More ETH will be waiting for you in case the Ethereum hits the next all-time high!

FAQ

What are the benefits of staking Ethereum in 2025?

The benefits of staking Ethereum include earning passive income through staking rewards, contributing to network security, and participating in the future of Ethereum without needing advanced trading skills.

How much ETH do I need to start solo staking?

To run a validator node, you need a minimum of 32 ETH. However, you can also join staking pools or use centralized exchanges where there are no minimum requirements, making it accessible for smaller investors.

What is StakeWise, and how does it work?

StakeWise is a decentralized solo staking platform that allows users to stake their Ethereum and earn rewards. It offers a user-friendly interface, flexible staking options, and the ability to participate in DeFi applications with your staked assets.

Are there risks associated with staking Ethereum?

Yes, risks include potential slashing (loss of staked ETH for validator misconduct), liquidity constraints (locked funds), and market volatility (fluctuations in ETH value affecting your rewards).

How can I start staking Ethereum in 2025?

You can start staking by choosing your preferred method: solo staking (running your validator), joining a staking pool, or using a centralized exchange. Follow the platform’s instructions to deposit your ETH and begin earning rewards.

How do I claim my staking rewards?

Staking rewards are usually distributed automatically to your wallet or account on the platform you used for staking. Depending on the method, you may be able to withdraw or reinvest these rewards according to the platform’s guidelines.