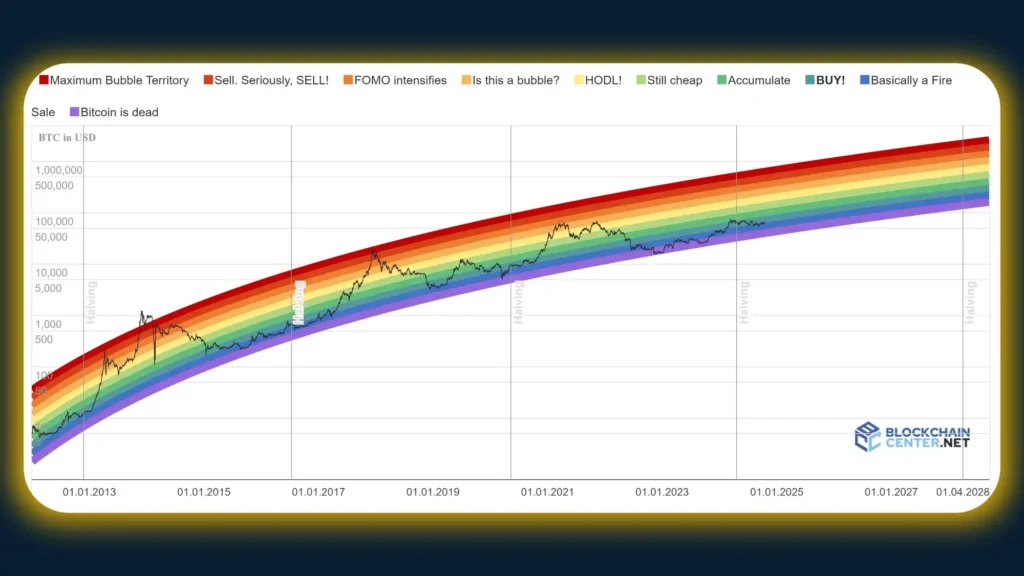

It is the Bitcoin Rainbow Chart is a color-coded, logarithmic regression chart that depicts the price history of Bitcoin to help investors understand long-term trends in markets. Each color band represents distinct market sentiment ranging from “Fire Sale” (undervalued) to “FOMO” (overvalued)–making it easier to judge whether Bitcoin is too expensive, reasonably priced, or is a bargain based on past performance. It’s a simple emotional-filtering tool that turns complicated price data into useful insights, particularly beneficial in long-term strategies, such as the HODLing strategy or dollar-cost average.

Greetings, you other crypto enthusiasts! If at any one point, you’ve had to swim through graphs and gauge and lose yourself in the middle of trying to finally determine the right time to invest in Bitcoin, don’t worry.

Table of Contents

Today, we’re diving into a delightful tool that simplifies the chaos: The Bitcoin rainbow chart price forecast.

What is the Bitcoin Rainbow Chart?

I would like to picture a tool that takes the history of the Bitcoin and its price graph to turn into actually colorful and quite understandable.

That’s exactly what the rainbow chart Bitcoin does! Unlike other complex lanterns crowded with lines and numbers that bewilder any ordinary mind, this one relies on various colorful hues symbolizing different market moods.

It might be useful to consider it as the mood ring for Bitcoin!

But do not be deceived by the chart’s colors, as the Bitcoin rainbow chart is based on a rock-solid math logic called logarithmic regression.

It translates to a simple concept that just filters out most of the digital currency’s volatility, allowing you to properly focus on the trends.

How Does the Bitcoin Rainbow Chart Price Forecast Work?

The Bitcoin rainbow chart price prediction has several colour bands all of which encapsulate different levels of market frenzy or prudence. Here’s a quick rundown of what those colors mean:

- Blue/Dark Green Bands: Let’s start with the “Fire Sale”, or the “Accumulate Zones”. If, of course, Bitcoin is in these colors now, it may be an undervalued currency. Instead of being in a mad rush, the market is like a turtle, and smart investors should now look at this as the time to buy.

- Green to Light Orange Bands: These represent a “Still Cheap” or “HODL” area. Here, the price of Bitcoin is more or less stable, and the overall tone of the market is more or less balanced. This is the kind of ride where it may just be wise to hold on to an investment rather than try to change it.

- Orange to Red Bands: Welcome to the world of FOMO (Fear of Missing Out), or, even better, Sell, Seriously Sell. When Bitcoin gets to these rates, it may have reached its Overvalued State with corresponding market hype or excitement. This is where the idea of ‘caution’ should be your trusted friend; selling might be your safest option.

The beauty of the Bitcoin rainbow chart live is that it doesn’t incur any costs. It’s not necessary to write large formulas, or use complex technical analysis here! This one gives a great view of the long-term trends of Bitcoin so you can see if the market is gearing towards greed or fear.

Using the Rainbow Chart for Your Investment Strategy

You can find the Bitcoin rainbow chart live today on platforms like Blockchain Center and TradingView. Just remember to approach any alternative versions with a pinch of salt; they might not be as reliable as the original.

One of the greatest advantages of using the Bitcoin rainbow chart is that it’s particularly useful for long-term strategies like dollar-cost averaging. This method helps mitigate the risks of volatility by spreading your investments over time.

However, keep in mind that this chart isn’t a crystal ball. It is historical data and hence cannot forecast the future despite being an important predictor of a firm’s cash flows. The behavior of the price of Bitcoin may be affected by political and other social factors which are outside the market such as new laws.

Limitations of the Bitcoin Rainbow Chart

Nonetheless, the Bitcoin Rainbow Chart 2023 is a great system that enables us to understand the position of Bitcoin, so we should not use only this chart. On its own, it’s not of much value, but when incorporated as part of an overall investment plan, then it is quite effective.

Well, how does this rainbow magic come into your picture of investment? Here’s a practical approach:

- Regularly Check the Chart: Stay updated regarding the location of Bitcoin in its price perspective through the help of the Bitcoin rainbow price chart.

- Combine with Other Tools: Trade it in conjunction with other analysis tools such as the Bitcoin linear regression rainbow chart to gain more insight into the markets.

- Be Aware of Market Sentiment: Always think of the general macroeconomic and market trends and events. This may be because it takes some time before the effect of a key event in the world of crypto valuta, such as the appearance of a new coin, is incorporated into the Bitcoin halving rainbow chart.

The Future: Bitcoin Rainbow Chart 2024 and Beyond

With that kind of thinking, it comes as no surprise that many investors are wondering what the Bitcoin Rainbow Chart 2024 will show. Will continue inventing a Bitcoin high, or will we witness a dip? Remember that a chart can provide significant information; however, you need to bear in mind that the chart is not a magician.

For those who are peering into the crystal ball of the bitcoin rainbow chart 2030 the above same rules will apply. Trends are great resources for forming opinions but must be checked against current events and the business environment.

Read Also: ASML Stock, GPU Coins, and a Decentralized Future: How Semiconductor Giants Impact Crypto

Conclusion: Embrace the Rainbow

As of May 2025, Bitcoin is trading at or above $105,000, indicating a 2.82 percent increase in daily trading and is close to reaching its record of $109,026.02. The surge is due to increasing institutional investments and favorable regulatory developments such as those of the U.S. Senate’s advancement of the GENIUS Act and renewed investor demand in the face of global economic uncertainty.

The Bitcoin Rainbow Chart currently places Bitcoin in the “Maximum Bubble Territory,” meaning that the cryptocurrency could be valued overvalued in the current market. As long as the momentum for bullish growth continues however, experts warn that Bitcoin may experience short-term fluctuations before it could reach higher prices later in the year.

Therefore, it is well worth incorporating the Bitcoin rainbow chart price forecast into understanding the workings of the price of Bitcoin. Simplified by color it associates important pieces of information, making the process of identifying opportunities and threats easier.

So, whatever point in time you find yourself at when you’re doing the Bitcoin Rainbow chart live and even when you’re wondering about the usefulness of the Bitcoin Rainbow price chart indicator, be sure to get a balanced strategy. The rainbow is indeed beautiful, but it’s what you get at the end: the leprechaun’s gold!

Hopefully, you have gotten a taste of the fun topics in Bitcoin with the rainbow chart. Want to stay updated on the latest trends in cryptocurrency and blockchain? Subscribe and share for more colorful insights. See you next time!

1. What is the Bitcoin Rainbow Chart?

The Bitcoin rainbow chart is a color-coded visual tool used to analyze Bitcoin’s price trends over time. It uses logarithmic regression to smooth out Bitcoin’s volatility and helps investors see where Bitcoin might be undervalued or overvalued based on historical data. The chart is divided into multiple color bands, each representing different market sentiments like “Fire Sale” (undervalued) and “FOMO” (overvalued).

2. Can the Bitcoin Rainbow Chart Predict Bitcoin’s Future Price?

While the Bitcoin rainbow chart price forecast can give insights into Bitcoin’s historical price trends, it doesn’t guarantee future predictions. The chart is based on past performance using logarithmic regression and cannot account for external factors like market regulation, breaking news, or major economic shifts. It’s a helpful tool for long-term trends but should not be the only source for investment decisions.

3. Where Can I Find the Bitcoin Rainbow Chart Live?

You can check the Bitcoin rainbow chart live on platforms like BlockchainCenter.net or custom versions on TradingView. The Bitcoin rainbow chart live today gives real-time updates on where Bitcoin’s price stands within the chart’s color bands.

4. What Do the Different Colors on the Bitcoin Rainbow Chart Mean?

The rainbow chart’s colors represent different market conditions:

Blue/Dark Green: “Fire Sale” or “Accumulate” zones, indicating Bitcoin might be undervalued.

Green/Yellow: More stable prices, suggesting it’s time to “HODL.”

Orange/Red: Represents “FOMO” or “Sell” zones, indicating Bitcoin could be overvalued.

5. Is the Bitcoin Rainbow Chart Useful in 2024?

Yes, the Bitcoin Rainbow Chart 2024 is still a valuable tool for analyzing long-term trends. However, it’s essential to combine this with other market indicators, as the chart is based on historical data and doesn’t account for future events like regulations or technological shifts in the crypto space.

6. How Accurate is the Bitcoin Rainbow Chart Price Prediction?

The Bitcoin rainbow chart price prediction can provide a rough idea of where Bitcoin might be heading, but it’s not a foolproof forecast. It works well for understanding long-term trends but doesn’t take into account sudden price swings due to external factors. Always combine it with other tools and strategies.

7. What is the Bitcoin Halving Rainbow Chart?

The Bitcoin halving rainbow chart specifically focuses on Bitcoin’s price movements in relation to halving events (when the reward for mining Bitcoin is halved). Halvings historically impact Bitcoin’s price by reducing the supply rate, making this chart useful for long-term price projections.

8. Can the Bitcoin Rainbow Chart Predict Prices Until 2030?

The Bitcoin Rainbow Chart 2030 is speculative. While the chart gives insights into long-term trends, forecasting prices until 2030 based solely on the rainbow chart is risky. Future regulatory changes, technological advancements, and market sentiment could drastically impact Bitcoin’s price.

9. What is the Bitcoin Rainbow Price Chart Indicator?

The Bitcoin rainbow price chart indicator is a visual guide to help investors decide if Bitcoin is currently undervalued, fairly priced, or overvalued. It uses logarithmic regression to track Bitcoin’s historical price movements and helps in long-term investment strategies.

10. Is There a Bitcoin Cash Rainbow Chart?

Yes, there is a Bitcoin Cash rainbow chart, which works similarly to the Bitcoin rainbow chart but focuses on the price movements of Bitcoin Cash. The chart helps investors track the historical price trends of Bitcoin Cash and gauge potential buying or selling opportunities.

11. What is the Bitcoin Log Chart Rainbow?

The Bitcoin log chart rainbow is a logarithmic scale chart that smooths out Bitcoin’s price fluctuations over time. It provides a long-term perspective on price trends, making it easier to visualize Bitcoin’s growth over the years. It is commonly used alongside the rainbow chart to predict potential price movements.

12. How Does the Bitcoin Rainbow Chart Compare to Other Bitcoin Charts?

The Bitcoin charts rainbow is unique because it provides a simplified, color-coded view of market sentiment, while other Bitcoin charts may rely on more complex technical indicators. The rainbow chart focuses on long-term trends rather than short-term price movements, making it a great tool for long-term investors.

1 thought on “Understanding the Bitcoin Rainbow Chart Price Forecast”