Anyone interested in trading on Gemini needs to know the charges for making trades to avoid incurring expensive fees. Trading costs can differ depending on the kind of order, the currency, and if you’re a buyer or a seller differently, so it’s best to be informed. This guide also explores the instant order fees to how the maker-taker model in Gemini operates so that you have all the information you need when dealing with Mobile fees.

Table of Contents

Why Are Fees Important for Crypto Traders?

Fees directly impact your potential profit. The more you trade, the more significant these fees can become. In crypto, knowing fee structures helps you:

- Save on trades by choosing the right order types.

- Take advantage of volume-based discounts.

- Ensure transparency with clear, upfront costs.

Gemini’s mobile fees may seem intricate at first glance, but they’re designed to suit both occasional and high-frequency traders.

1. Instant Order Mobile Fees

Gemini’s Mobile Instant Order Fee structure applies to all trades executed via the mobile app, with two main components:

- Convenience Fee: This is a small percentage that is added to the existing market price and which has the effect of providing a definite, ‘guaranteed,’ price whenever one execution order is placed for an instant.

- Transaction Fee: Charged based on the size of your order, the transaction fee is displayed before confirming your trade.

This breakdown helps Gemini maintain smooth trading experiences with locked-in prices, a plus for traders who want certainty in volatile markets.

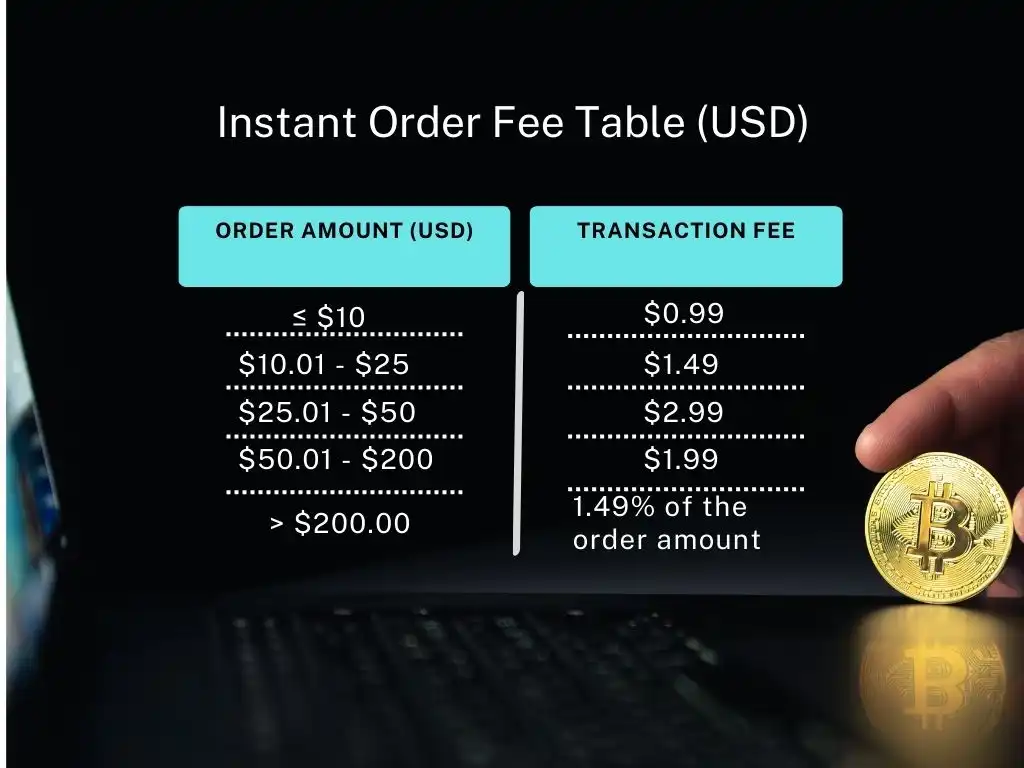

Instant Order Fee Table (USD)

Here’s a quick look at the fees by USD order amount:

2. Mobile Limit Order Fees

Limit Orders on Gemini follow a different fee structure than Instant Orders. Here’s what makes them unique:

- No Convenience Fee: Limit Orders don’t incur this fee, so you save by setting your desired price rather than taking the market price.

- Fixed Transaction Fee: All Limit Orders, regardless of the amount, have a flat fee of 1.49% of the order value.

The Limit Order option is ideal for traders who don’t need instant execution and want to save on fees.

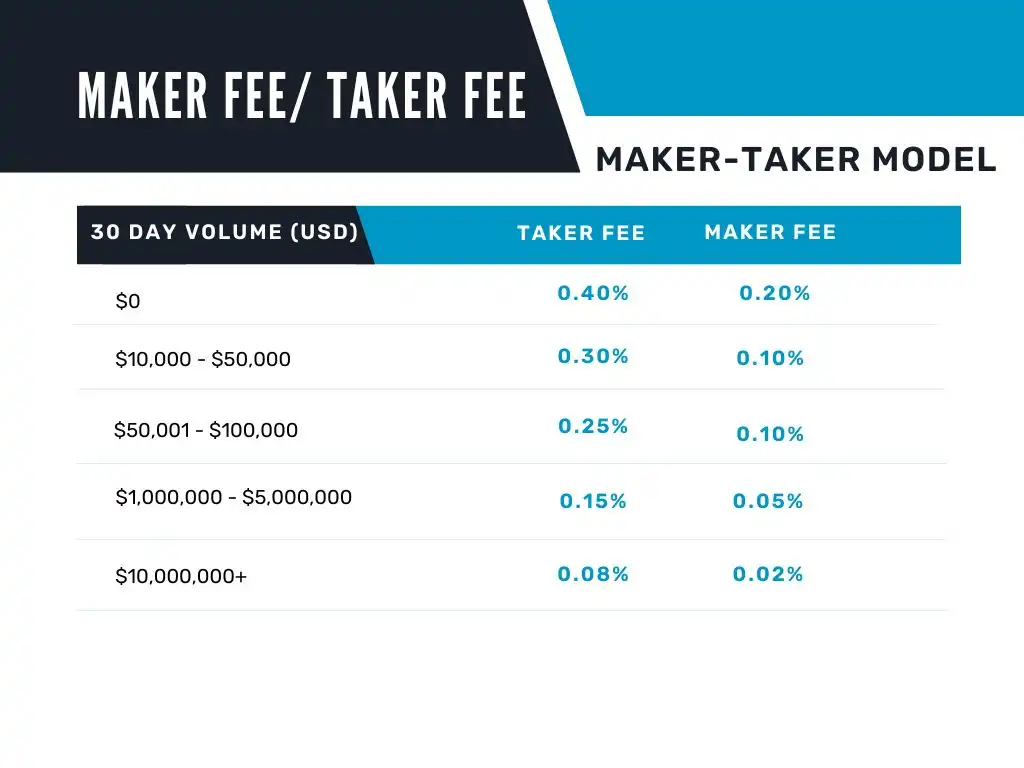

3. Maker and Taker Fees Explained

Gemini uses a maker-taker model for determining trading fees for Limit Orders, based on how you contribute liquidity to the platform:

- Taker Fees: If you place an order that’s filled immediately, you’re removing liquidity and will pay a higher taker fee.

- Maker Fees: If your order rests on the order book, adding liquidity, you’ll incur a lower maker fee once it’s filled.

Here’s a glance at Gemini’s maker-taker fees based on trading volume:

As you can see, the more you trade, the lower your fees—especially for market makers.

4. Fee Examples

Instant Order Example

Let’s say Alice wants to buy $100 of BTC using USD. The Gemini market price for BTC is $4,000. Here’s how her fees would look:

- Quoted Price: $4,020 (market price + 0.50% Convenience Fee).

- Transaction Fee: $2.99.

- BTC Received: 0.02413 BTC.

So, Alice would pay $4,020 plus a $2.99 fee to complete this purchase.

Limit Order Example

If Bob wants to buy $1,000 of BTC with a Limit Order of $3,900, his order will rest on the book until it fills. If filled as a maker:

- Fee: $10 (1.49% Transaction Fee on $1,000).

With a lower fee and no Convenience Fee, Limit Orders are more cost-effective for non-urgent trades.

5. Fee Discounts for High-Volume Traders

For traders with substantial trading volumes, Gemini offers fee reductions:

- Tier-Based Discounts: Starting at $10,000 in 30-day trading volume, taker and maker fees gradually decrease.

- Automated Recalculations: Fees are recalculated daily based on your trailing 30-day volume means potential daily discounts for active traders.

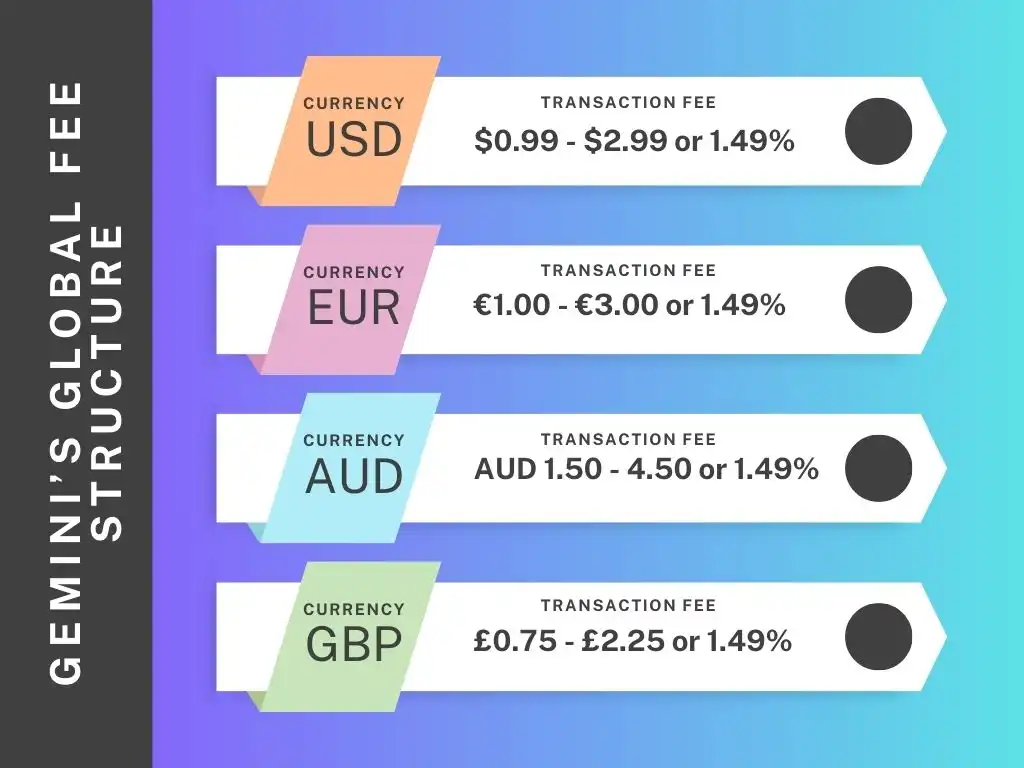

6. Gemini’s Global Fee Structure

Since Gemini is available globally, fees vary by currency and region:

This adaptability ensures that Gemini’s fees remain competitive and consistent regardless of location.

FAQs on Gemini’s Mobile Fees

Are fees charged when I place or when my order fills?

Fees are calculated at the time you place your order. For partially filled orders, fees only apply to the filled portion.

Can I avoid Convenience Fees on Gemini?

Yes, placing a Limit Order instead of an Instant Order allows you to avoid the Convenience Fee.

What’s the difference between Maker and Taker fees?

Maker fees apply to orders resting on the order book, adding liquidity. Taker fees are higher and apply to orders filled immediately, removing liquidity.

How often does Gemini update its fee structure?

Gemini recalculates fees daily, based on 30-day trading volumes, and provides notice of any structural changes.

Do fees vary depending on currency?

Yes, fees differ across fiat currencies such as USD, EUR, and AUD. These fees are shown in your app before confirming the trade.

Is there a discount for high-frequency traders?

Yes, high-volume traders enjoy reduced maker and taker fees, with savings increasing at higher volumes.

Conclusion on Gemini’s Mobile Fee Schedule

This fee structure of mobile is also highly flexible and suits both the new as well as professional traders of Gemini. Having gotten to know what Instant and Limit Orders entail, as well as how the Maker and Taker fees operate it is easy to trade with high efficiency. This model allows high-frequency trades to get cost efficiencies through volume discounts and positions Gemini very competently in the cryptocurrency exchange market.

Top crypto influencers