Muzaffarabad, Azad Kashmir, is currently under intense scrutiny as fighter jets roar overhead, signaling an escalation in the ongoing tensions between India and Pakistan. The sound of planes flying low fills the air as residents brace themselves for potential further conflict. This sudden military action near the Line of Control (LoC) has heightened fears of a larger-scale confrontation between the two nations, already plagued by decades of territorial disputes. As the region remains on high alert, the uncertainty surrounding the situation is creating unrest both locally and internationally, with people unsure of what the coming hours may hold.

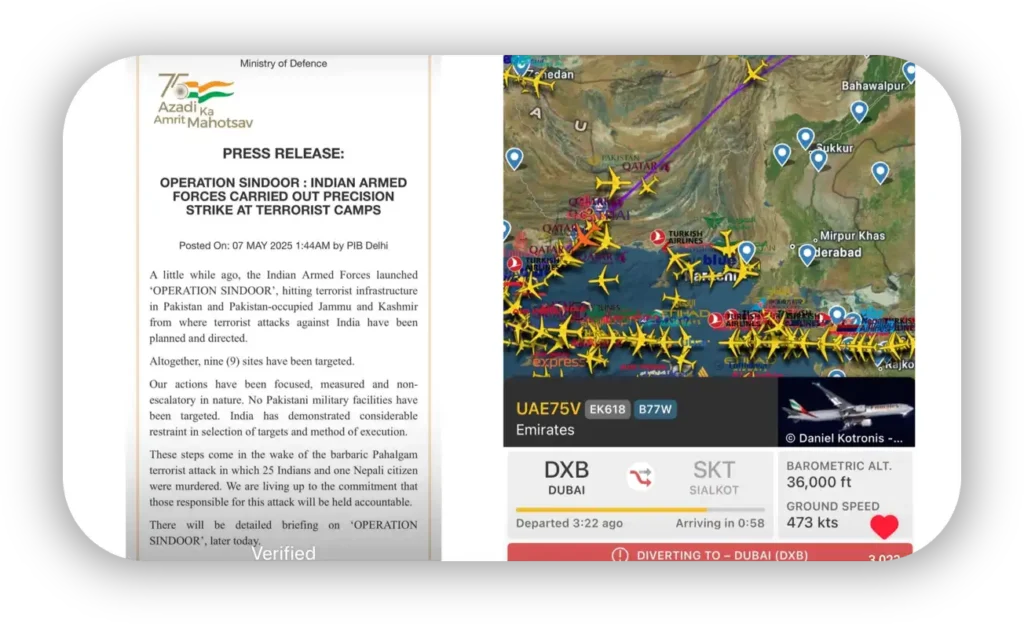

On May 7, 2025, the Indian Armed Forces reportedly launched ‘Operation Sindoor’, a precision military strike targeting nine terrorist camps in Muzaffarabad and Pakistan-occupied Jammu and Kashmir. The official press release by the Indian Ministry of Defence emphasizes that the operation was carried out with strategic restraint, avoiding Pakistani military facilities and focusing solely on terror infrastructure believed to be responsible for orchestrating attacks on Indian soil — particularly the recent Pahalgam terrorist attack, which claimed 26 lives, including one Nepali citizen.

Simultaneously, live flight tracking data showed diversions and reroutes over Pakistani airspace, including a flight from Dubai to Sialkot that was redirected back to Dubai, indicating heightened regional tension and possible airspace restrictions in response to the strike. A detailed briefing on the operation is expected later, as the situation continues to develop.

In the midst of this geopolitical instability, crypto markets are feeling the weight of investor caution. With rising risks and regional volatility, short-term price drops in cryptocurrencies are expected as investors seek to mitigate potential losses amid such uncertainty.

Strategic Implications of the Muzaffarabad Conflict

The geopolitical tensions that surround Muzaffarabad, which is located in the region where the Kashmir dispute,s raise a number of alarms for global investors:

- Greater regional instability The threat of war could impact the global sentiment towards risk. Investors are prone to withdraw from risky investments like crypto in uncertain times.

- Market chaos across the globe: If the war grows more intense, it could cause interruptions to internet services as well as capital flight and the halting of local crypto-related activities across Pakistan.

- The global reaction States and investors watching Pakistan’s rapid growth in digital and fintech adoption might temporarily stop or defer investments.

These indicators suggest that, while this conflict is a regional one, its economic signaling is global and is particularly evident when you consider Pakistan becoming a crypto-curious marketplace.

Crypto and the Pakistan Connection: Why It Matters Now

Pakistan has rapidly emerged as a hub for cryptocurrency adoption, which is one of the top countries in terms of interest from users. The recent visit by the Chief Executive Officer of Binance CZ was more than just symbolicit was actually an opportune reference to the potential of Pakistan’s fintech sector.

However, here’s where things become difficult:

- Positive momentum shattered The visit was meant to reinforce the Pakistani crypto narrative. The current conflict has shattered the narrative, reversing optimism with a sense of skepticism.

- Refusal by institutions: Companies planning to join forces with Pakistani regulators or exchanges could put off plans due to regulatory or regional opposition.

- Fear of the user Local Pakistani users could temporarily transfer funds to stablecoins or off-ramp to fiat due to fears of restrictions or blackouts.

Could Crypto Prices Drop?

The cryptocurrency market is globally oriented. However, it responds strongly to the fear of uncertainty, fear or the fear of (FUD). Although Pakistan isn’t yet dictating the cryptocurrency market as does China or the U.S. or China, the following are reasons why prices might be affected:

- A short-term spike in volatility The fear-driven selling of stocks can lead to temporary price declines, particularly with emerging market currencies and altcoins, which are popular within South Asia.

- Narrative Reversal: What was once a positive report of cryptocurrency growth in Pakistan is now dominated by headlines from the geopolitical world, causing traders to lower their risk.

- The flight to safety Bitcoin and stablecoins could be more volatile as investors seek to safeguard their portfolios.

Final Thoughts

The conflict between India and Pakistan in Muzaffarabad isn’t just an issue of politics; it’s also an economic signal. In light of this week’s Binance CEO’s trip to India bringing optimism for growth in crypto markets in the region, the timing of this attack could not be better.

Although the cryptocurrency market will not be wiped out by this one event however, it could take a moment, reflect, and then retract to some extent — but at the very least in the short-term.

Investors must be watching this area carefully, not just to protect themselves from human rights but also as the long-term future for cryptocurrency within Pakistan, which is a country with 240 million inhabitants -is on the line.