The Aleo blockchain represents the next generation of decentralized systems, combining privacy, scalability, and sustainability.

At the heart of its design lies Aleo Tokenomics — the economic structure that determines how Aleo Tokens (ALEO) are created, distributed, and used within the ecosystem.

Tokenomics defines not only the supply and demand mechanics but also how participants—validators, provers, and developers—are incentivized to maintain and expand the network. In Aleo’s case, the system integrates zero-knowledge proofs (ZKPs), ensuring both security and privacy while maintaining an efficient, decentralized economy.

Read Also our in depth guide on Tokenomics Here

Table of Contents

Aleo Token Utility and Use Cases

The Aleo Token (ALEO) serves as the lifeblood of the network, powering every on-chain activity and ensuring all participants are rewarded for their contributions.

Aleo’s utility model is designed to promote fairness, decentralization, and continuous ecosystem growth.

Core Functions and Network Benefits

- Transaction Fees:

Every on-chain transaction on Aleo requires a fee paid in ALEO. This ensures the network remains efficient and prevents spam transactions. - Prover and Validator Rewards:

Provers—who verify zero-knowledge proofs—and validators—who secure the blockchain—earn ALEO as compensation for their computational and network efforts. - Staking Incentives:

Users can stake their ALEO tokens to support validators and earn a share of network rewards, ensuring both passive income and network stability. - Governance Participation:

Token holders can participate in decision-making, voting on upgrades and proposals that guide Aleo’s future. - Developer Incentives:

Builders who contribute to the ecosystem by launching decentralized applications (dApps) or enhancing Aleo’s infrastructure receive ALEO rewards through grants and ecosystem programs.

In essence, the token is more than a currency—it’s the foundation of Aleo’s incentive-based, self-sustaining ecosystem.

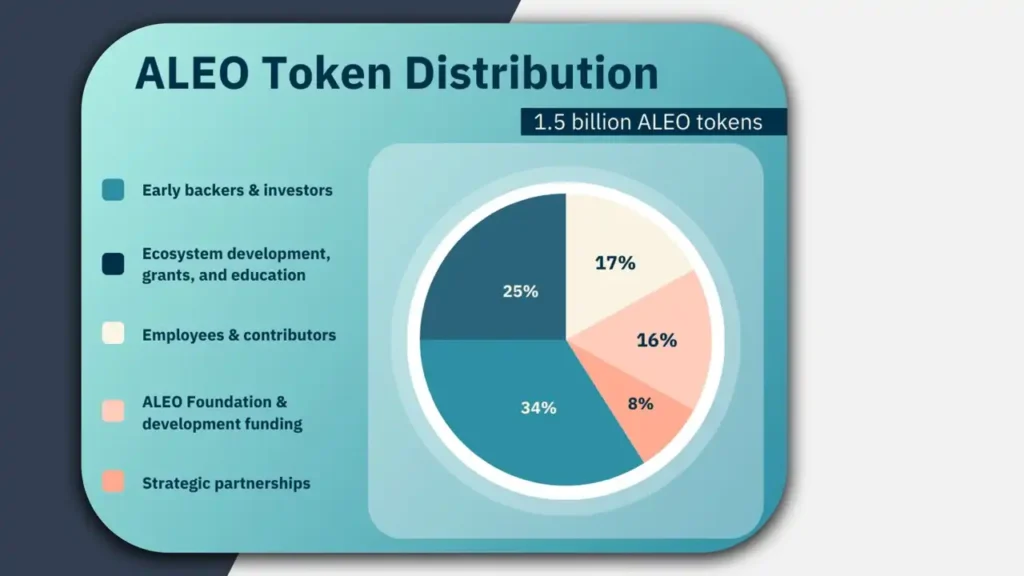

Aleo Token Distribution Model

Aleo’s token distribution strategy aims to balance early support, community development, and long-term sustainability.

At the time of its mainnet launch, the total supply was capped at 1.5 billion ALEO tokens, distributed as follows:

| Category | Allocation | Purpose |

|---|---|---|

| Early Backers & Investors | 34% | Provided initial funding and growth capital |

| Ecosystem Development & Grants | 25% | Incentives for developers, researchers, and educators |

| Employees & Contributors | 17% | Rewards for internal team and contributors |

| Aleo Foundation & Operations | 16% | For governance, infrastructure, and long-term projects |

| Strategic Partnerships | 8% | Collaborations and integrations with other blockchain initiatives |

Visual Breakdown of Allocation Categories

The allocation ensures that both early supporters and new entrants benefit from Aleo’s long-term vision.

Unlike many blockchain projects, Aleo’s foundation plays a transparent, decentralized role—designed to ensure no single entity controls the network’s direction.

Aleo Token Emission and Inflation Control

Aleo employs a controlled emission model to prevent excessive inflation while maintaining healthy incentives for validators and provers.

The system is designed to distribute new tokens gradually, encouraging steady ecosystem growth rather than speculative spikes.

| Year | Block Reward (ALEO) | Annual Inflation | Network Phase |

|---|---|---|---|

| 1 | 23 ALEO | 13.5% | Network bootstrap period |

| 5 | 14 ALEO | 6.8% | Stabilization phase |

| 10 | 8 ALEO | 1.6% | Mature network equilibrium |

Long-Term Sustainability via Emission Decay

As block rewards decline, the system encourages users to rely on staking and transaction-based incentives.

This emission decay ensures Aleo transitions smoothly from growth-driven inflation to long-term stability—mirroring the economic logic seen in networks like Bitcoin but adapted for zero-knowledge computation.

Aleo Token Burning Mechanism

To complement its emission policy, Aleo incorporates a token-burning mechanism that helps control supply and promote long-term value growth.

Each transaction on the Aleo blockchain burns a small fraction of the fee paid, permanently removing that portion from circulation.

Deflation Through Transaction Fees

- Supply Reduction: By burning part of the transaction fees, Aleo gradually decreases total token availability.

- Scarcity Creation: This built-in deflation increases the value of remaining ALEO tokens over time.

- Economic Balance: The burn mechanism counteracts new token emissions, achieving a stable equilibrium between inflation and deflation.

| Year | Estimated Supply (Billion) | Burn Rate (%) | Effective Inflation (%) |

|---|---|---|---|

| 1 | 1.5 | 0.3 | 13.2 |

| 5 | 2.1 | 0.7 | 6.1 |

| 10 | 2.6 | 1.2 | 0.4 |

This model ensures that as Aleo’s adoption and transaction volume grow, the system becomes naturally deflationary—enhancing token scarcity and maintaining long-term sustainability.

Aleo’s Staking Model

Aleo’s staking system connects user participation with network stability, making it an integral part of its tokenomics.

Validators, provers, and delegators form the backbone of this model, securing the blockchain while earning continuous rewards.

Validator and Prover Ecosystem

- Validators are responsible for confirming transactions and maintaining network consensus.

- Provers generate and verify zero-knowledge proofs, ensuring transaction privacy and integrity.

- Delegators can stake ALEO tokens through trusted validators to earn passive rewards.

| Parameter | Value |

|---|---|

| Minimum Stake | 5,000 ALEO |

| Reward Cycle | Every block (~6 seconds) |

| Average APY | 8–12% |

| Lock-Up Period | 21 days |

| Unstake Delay | 7 days |

This model promotes active participation, reduces sell pressure, and ensures a decentralized, secure environment.

Why Aleo’s Tokenomics Stands Out

Aleo’s tokenomics distinguishes itself through a privacy-preserving, incentive-aligned economic structure.

What Makes It Unique:

- Zero-Knowledge Proof Integration:

Unlike traditional Proof-of-Stake networks, Aleo uses ZKPs to validate transactions privately while maintaining network transparency. - Balanced Emission and Burn Policy:

The combination of gradual emission decay and deflationary fee burns provides economic stability and growth potential. - Incentive Alignment:

Rewards for developers, validators, and provers ensure active participation and ecosystem expansion. - Decentralized Governance:

Aleo Foundation’s transparent operations promote fairness and inclusion, fostering trust across the network.

Together, these features create a privacy-first blockchain economy that values both transparency and sustainability.

FAQs About Aleo Tokenomics

1. What is Aleo Tokenomics?

Aleo Tokenomics refers to the economic model governing the creation, distribution, and utilization of ALEO tokens across its decentralized network.

2. How many Aleo Tokens exist?

At launch, the total supply was 1.5 billion ALEO, expected to grow gradually to approximately 2.6 billion through controlled emissions.

3. How does Aleo maintain token value?

By combining staking incentives, transaction fee burns, and decreasing emissions, Aleo maintains a stable and deflationary token supply.

4. Can users stake ALEO?

Yes, users can stake ALEO tokens with validators to secure the network and earn passive rewards.

5. What makes Aleo different from other blockchain projects?

Aleo’s integration of Zero-Knowledge Proofs (ZKPs) offers unmatched transaction privacy, while its emission-burn equilibrium ensures a sustainable token economy.

Related Reading (on Tokenomics)

Deepen your understanding of blockchain economics and token design with these resources from Pro2Crypto:

- 🔗 Ultimate Guide to Tokenomics

- 🔗 How to Evaluate Tokenomics Effectively

- 🔗 Understanding Tokenomics for NFTs

- 🔗 How to Analyze Crypto Tokenomics: Master Guide

Summary and Final Thoughts

Aleo’s tokenomics represent a carefully balanced system built on privacy, fairness, and sustainability.

Its economic structure merges controlled emissions, deflationary burns, and staking-based rewards to form a decentralized, privacy-first financial ecosystem.

Key Takeaways

- Fair distribution promotes decentralization and growth.

- Emission control and fee burns sustain long-term token value.

- Staking links user rewards directly with network stability.

- Zero-knowledge proofs enable privacy without compromising security.

Aleo stands as a leading example of how blockchain tokenomics can evolve beyond speculation—toward real-world utility, community-driven participation, and enduring sustainability.

Sources

Aleo Tokens | Aleo

A zoom on Aleo’s tokenomics (ALEO) – OAK Research

ALEO Token: Its Functions and Tokenomics – Bittime

Aleo Tokenomics Overview — Bocca – Mirror.xyz

State of Aleo Q4 2024 | Messari

How to Evaluate Tokenomics Effectively-Pro2crypto