Cryptocurrencies have taken the world by storm, attracting the interest of tech enthusiasts, investors, and the general public. The market of digital currencies has seen unprecedented growth and volatility from Bitcoin’s spectacular rise to the increase of countless altcoins, Yet, amidst the excitement and potential for massive returns, a pressing narrative looms: Cryptocurrency is a bubble, is it waiting to burst?

In this blog, we’ll delve into the arguments for and against the notion that cryptocurrency is a bubble, exploring the signs of speculative frenzy and the factors that could underpin a sustainable future for digital currencies. Whether you’re a seasoned investor or a curious observer, join us as we unpack the complex dynamics of the cryptocurrency phenomenon.

Bitcoin is the primary coin of digital currency which plays cryptocurrency’s foundations, That’s why we will take Bitcoin as an example in this discussion.

“Cryptocurrency is a bubble” is a common narrative, considering it as same as some market bubbles in history which happen when speculation in a market value of an asset increases rapidly, resulting in a bubble burst due to the investor’s loss of trust and making them pull out their investment from the market. In the example below,

The South Sea Company undertook the UK government’s debt and received an exclusive charter for South Sea trade in 1720. This sparked a tenfold surge in its share prices, driven by insatiable investor demand. The company capitalized on this by issuing more shares for various ventures, including a notoriously vague project promising great advantages without revealing its nature.

The speculative bubble eventually burst, leading to the arrest of company executives, the financial ruin of government officials, and a wave of suicides among those affected by the collapse.

Do you think Bitcoin will suffer the same fate as the South Sea Company? Let’s delve into this topic and explore the potential parallels and differences. By the end of this blog, you’ll be equipped to form a well-rounded narrative either supporting or opposing the notion that cryptocurrency is destined to collapse.

Table of Contents

Blockchain Basics: Decentralization, Security, and its Role in Cryptocurrency

Understanding the basics of blockchain and its relationship to Digital currencies is crucial for broadening our perspective on “cryptocurrency is a bubble”. Here’s a simplified explanation:

Blockchain offers a decentralized system where authority is shared among all participants, making data modification nearly impossible. This decentralized nature makes blockchain more trustworthy compared to traditional systems.

Blockchain technology emerged in the 1990s but was first implemented in 2009 by an anonymous developer known as Satoshi Nakamoto, who created Bitcoin using blockchain. This marked the beginning of the cryptocurrency boom.

Let us assume blockchain is a shop ledger recording all transactions. Each record in the ledger is a “block,” and all blocks together form a “blockchain.”

Each block contains three key elements:

- Data: Relevant transaction information (e.g., who sent and received Bitcoin).

- Hash: A unique reference number assigned to the block.

- Previous Hash: The unique reference number of the previous block, linking all blocks into a chain.

Changing the data in a block alters its hash, requiring subsequent blocks to be rehashed, which is practically impossible due to the extensive computational effort needed.

This process takes about 10 minutes per Bitcoin block, making it extremely difficult to alter the entire blockchain known as Proof of Work

Each contributor in the blockchain network possesses the blockchain copy. Any changes must be approved by the majority, ensuring data integrity this rule is known as the Consensus rule in a Bitcoin world.

So we can deduce from above that the Blockchain is decentralized and secure making it a more reliable system for various applications, with cryptocurrency being one prominent use case.

These basics reveal how blockchain boosts transparency and trust in digital transactions, challenging the idea that “Cryptocurrency is a Bubble.”

Bitcoin’s Market Behavior and Resilience: Insights from Historical Corrections and Recoveries

As the bitcoin is the first and is one of the most influential Digital currencies we would take Bitcoin as a reference example for cryptocurrency. Although Bitcoin has unique characteristics as a digital asset in the cryptocurrency market, its behavior and interaction with market forces are similar to the other traditional financial markets.

Understanding these similarities can help investors and traders asses Bitcoin markets effectively. The recovery after a correction in Bitcoin follows a pattern similar to other legitimate financial markets.

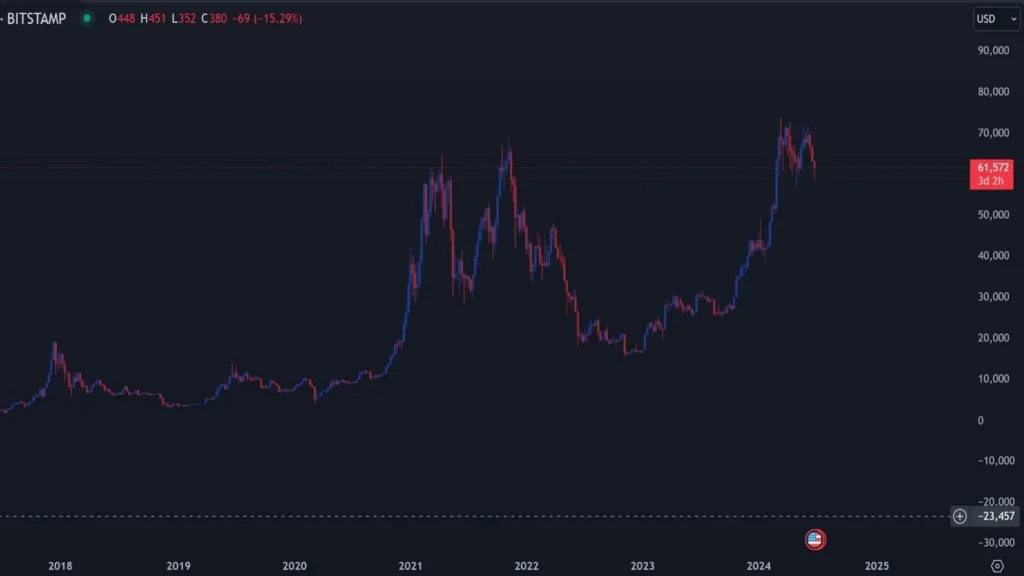

Here are some facts and figures from history, In2011 Bitcoin experienced a major correction when its price dropped from around $30 to below $2, Bitcoin peaked at over $1,000 in late 2013 but then corrected sharply to $200 by early 2015. Bitcoin made a new high of nearly $20,000 in December 2017 but then entered a prolonged bear market.

By December 2018, its price had dropped to around $3,200. Again, Bitcoin’s price was corrected in March 2020 due to broader market uncertainties surrounding the COVID-19 pandemic. It dropped below $4,000 briefly but quickly rebounded. made a new high of $64000.

Bitcoin entered a correction cycle in October 2022 and declined to $15000 followed by a recovery cycle making a new high of $73000 in March 2024. Following is the chart showing the correction followed by the recovery cycle of a Bitcoin.

It’s important to note from historical data that in every correction cycle, Bitcoin’s price didn’t even touch the previous low, making it resilient and indicative of an overall upward trend. This pattern suggests a strong underlying demand and growing confidence in Bitcoin as a long-term investment, despite periodic fluctuations and corrections.

Each of these corrections was followed by a recovery phase where Bitcoin not only regained its previous price levels but also reached new all-time highs in subsequent cycles. This resilience and ability to reach new peaks after corrections are often cited by proponents as evidence of Bitcoin’s potential long-term value and market maturity, countering claims that “cryptocurrency is a bubble.”

Impact of SEC Approval on Digital Currencies: Institutional Adoption and Long-Term Investment Opportunities

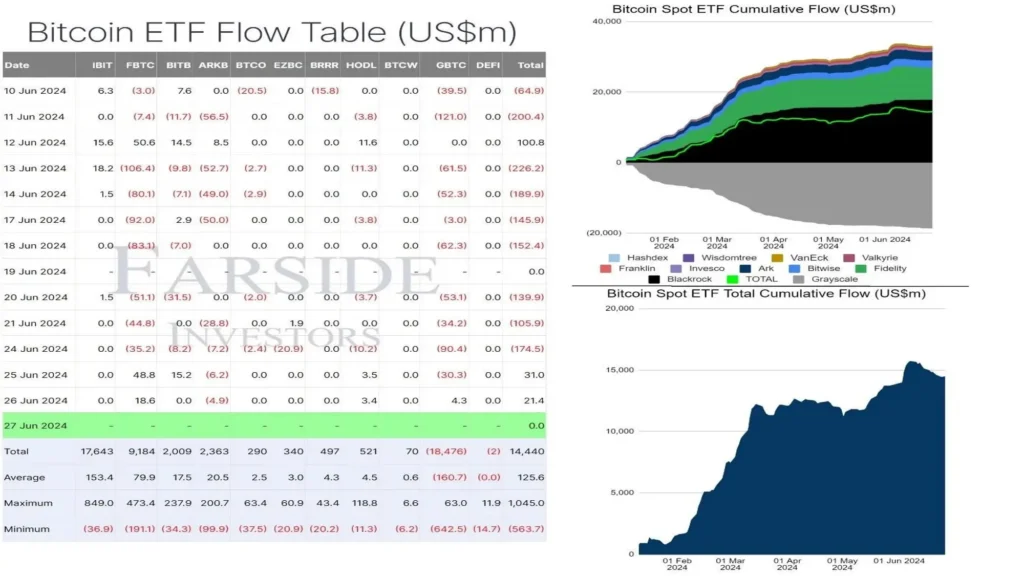

It is a significant development that the eleven spot Bitcoin ETFs have been approved by the SEC for trading on January 2024. This has opened the doors for institutional investors and major firms to invest billions of dollars in the market of Digital currencies.

Approval of these ETFs by the SEC is a strong endorsement of Bitcoin, making it a legitimate asset class in digital currencies.

Ease of Access for Investors to buy assets that track Bitcoin’s price without needing to hold the cryptocurrency directly. This simplifies the investment process and makes Bitcoin more accessible to a broader range of investors.

An expected increase in demand for Bitcoin in the cryptocurrency market because of the approval. Data Analysts predict that the fund’s influx could reach more than two hundred billion dollars over the next three years into these ETFs.

Various retirement plans, such as individual retirement accounts (IRAs) and pension funds, can now include Bitcoin due to the availability of the eleven spot ETFs. This makes Bitcoin a reliable option for long-term investment, challenging the view that “cryptocurrency is a bubble.”

Institutional Integration in the Market:

The entrance of heavyweight institutional investors into the crypto currencies market signals confidence in Bitcoin’s future and stability. Their interest is likely to attract more institutional investors, driving further investment in Bitcoin and other cryptocurrencies.

Firms like Blackrock, Fidelity, Ark International, and many more are trading bitcoin. Following is the chart of the Bitcoin’s Flow table from Farside.co showing the amount of Bitcoin accumulated and distributed by firms to date.

In this first chart to the left numbers in the black are accumulated Bitcoin in millions of dollars. IBIT is the iShares Bitcoin Trust of Blackrock, which bought a Total of 17643 million dollars of Bitcoin to date. Similarly, the chart on the Top Right shows that the accumulation of Bitcoin by Blackrock has been increasing to date. The third Chart in the Bottom Right shows the total flow of the bitcoin that has been increased to date.

These charts show the absolute interest of institutions in Bitcoin that are usually trading in other financial markets such as forex, commodities, and indexes, contradicting the notion that “cryptocurrency is a bubble.”

Conclusion: Looking Ahead, Digital Currencies Path Forward and Implications for Investors

Having grasped the concept of the blockchain, we can deduce that blockchain’s decentralized and secure nature makes it a more reliable system for various applications, with cryptocurrency being one of the most prominent use cases.

Bitcoin has demonstrated remarkable resilience through several major market corrections, consistently recovering and surpassing its previous highs to reach new, higher peaks. This pattern underscores Bitcoin’s strength and potential as a long-term investment, solidifying its place as a significant and enduring asset in the financial landscape.

The SEC’s approval of eleven spot Bitcoin ETFs for trading is a significant development. This move allows institutional investors to invest billions into the cryptocurrency market, solidifying Bitcoin’s legitimacy as an asset class. The ETFs make it easier for investors to gain exposure to Bitcoin without holding the cryptocurrency directly, broadening its accessibility.

This is expected to drive substantial demand, with potential fund inflows exceeding two hundred billion dollars over the next three years. Additionally, Bitcoin can now be included in various retirement plans, making it a viable long-term investment option

There is no doubt that the speculation does drive Bitcoin and other digital currencies in the cryptocurrency market, a key difference is the increased global adoption that includes the main investment institutes like fidelity, black rock, etc., indicating a long-term upward trend that supports Bitcoin’s enduring value which ensures it to be the trustworthy asset.

Thank you for joining us on this journey through Bitcoin’s past, present, and future. We hope this blog has provided valuable insights into the world of cryptocurrency. Whether you agree or have differing perspectives about “cryptocurrency is a bubble”, we encourage you to share your thoughts in the comments below. Your feedback and discussions are essential in shaping a comprehensive understanding of the ever-evolving landscape of digital currencies. Stay tuned for more insightful discussions and updates on cryptocurrency trends and developments.

5 thoughts on “Cryptocurrency is a Bubble: Facts vs Speculations.”