Explore the difference between Radium and Radium CPMM crypto, from DeFi platforms to automated market-making, and how they work together in the crypto ecosystem.

Okay, by now you probably have heard of Radium (also known as Raydium) and Radium CPMM Crypto, but what drives these behind-the-scenes giants? You’re not alone!

Table of Contents

Both of these shiny members of the crypto family are in the DeFi area, but they couldn’t be more dissimilar when it comes to their purpose.

It will help you grasp the idea of what Raydium and Radium CPMM Crypto are, and why people use these terms in the constantly evolving sphere of blockchain.

Today, we’re going deep into this topic with a simple, easy-to-understand, and entertaining way to make you a Radium and Radium CPMM pro.

Okay, so let’s get to it – please pull up your cup of coffee or your preferred cryptocurrency!

What is Radium Crypto?

Let’s start with Radium, the heavy hitter in the Solana blockchain ecosystem. Radium is designed to be a decentralized exchange (DEX) platform that facilitates everything from token swaps to yield farming, staking, and more.

Click here to check Radium price (Raydium price)!

If you’re in the DeFi space, you’ve probably encountered it as a fast and low-fee platform that empowers users to trade and manage assets with ease.

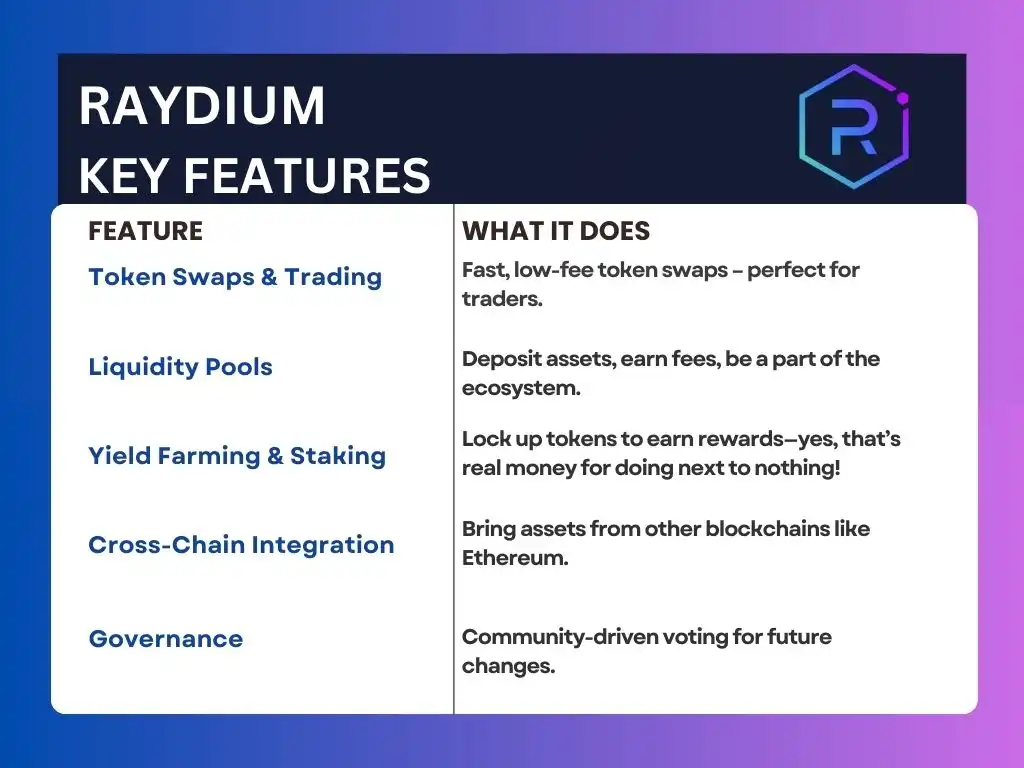

Perhaps you are asking yourself what drives Radium and how it stands from Radium CPMM crypto. We’ll get there, but first, let’s highlight the key features of Radium that set it apart:

- Trading & Token Swaps: Radium enables users to easily and cost-effectively swap out tokens while relying on Solana as the network of choice for virtually instant exchanges that cost almost nothing.

- Liquidity Pools: By adding assets to Radium’s liquidity pools, you can earn fees from trades that take place on the platform. The more liquidity you provide, the more you earn. Passive income, anyone?

- Cross-Chain Support: Radium is constructed on Solana’s base. It brings compatibility with other such blockchains for example Ethereum making it a powerful DeFi platform.

- Governance: Another great concept about Radium is that it operates on community governance. If you’re holding tokens, you get to partake in deciding what changes should be made on the platform, meaning the community will have a say in the future of the project.

What is Radium CPMM Crypto?

It is now high time that we proceeded to understand the actual difference between Radium and Radium CPMM crypto. If Raydium is the center of gravity of decentralized finance (DeFi), then Raydium CPMM (Constant Product Market Maker) is the power plant that makes it go around.

Radium CPMM is not an independent crypto asset, but a means for administration of trades and, therefore, of liquidity in the context of Radium.

It’s the part of Radium that makes sure transactions happen seamlessly and without hiccups.

In simpler terms: Radium CPMM helps manage how tokens are traded and how liquidity is distributed across the platform. The constant product formula (x * y = k) ensures that token prices stay balanced and predictable, which is vital for liquidity and smooth trading.

- Automated Market Making (AMM): Raydium CPMM is designed based on automated market-making (AMM) protocols. AMM is not like the one that operates using the order books through which value is calculated using supply and demand for tokens.

What this means is that trades occur instantly, and the prices remain reasonable without interference from people.

- Constant Product Formula: What’s more special here is the x * y = k formula. In this way, the total number of both tokens remains equal and each of the two tokens can be redeemed for the other.

It’s simple beautiful mathematics to make sure that liquidity doesn’t go haywire on the platform.

- Liquidity Management: Radium CPMM removes the uncertainty factors in the management of liquidity. By contributing to liquidity pools, users can provide the necessary capital for trades to happen and earn rewards in return.

How Raydium and Radium CPMM Crypto Work Together

This is how Raydium and Radium CPMM crypto collaborate Raydium is an integrated trading terminal that includes features of an exchange, launchpad, decentralized finance protocol, and a yield aggregator.

Raydium CPMM is the process that definitely governs liquidity and trading stability within Radium.

Here’s a simple way to look at it: Radium is like a bustling crypto marketplace, and Radium CPMM is the behind-the-scenes tech that ensures everything runs smoothly.

Without Radium CPMM, trades would be slower, less stable, and harder to execute.

Comparison Table: Difference Between Radium and Radium CPMM Crypto

Security in Radium vs. Radium CPMM Crypto

Security is a major concern in the world of crypto, and both Radium and Radium CPMM take it seriously. So, what makes them secure?

- Radium: Built on the Solana blockchain, Raydium inherits all the benefits of Solana’s security model. From fast transaction processing to cryptographic protocols, Radium ensures that your assets are safe from tampering or fraud.

- Radium CPMM: Since Radium CPMM operates using smart contracts, it’s crucial that these contracts are secure. Radium CPMM undergoes regular audits to minimize vulnerabilities and prevent exploits.

The Tokenomics: Radium vs. Radium CPMM Crypto

But even in terms of tokenomics, it is possible to identify the difference between Radium and Radium CPMM crypto.

- Radium: The staking and burning mechanisms of Radium to maintain its value over time are based on its tokenomics. However, It’s about creating a stable token that has real utility across the platform.

- Radium CPMM: On the other hand, Radium CPMM follows a more fluid model, where its value is closely tied to the liquidity pools and the activity within the Radium ecosystem. The more liquidity, the more Radium CPMM is worth.

FAQs: All Your Questions Answered on Radium and Radium CPMM Crypto

What’s the main difference between Radium and Radium CPMM crypto?

The difference between Radium and Radium CPMM crypto lies in their roles. Radium is a full DeFi platform, while Radium CPMM is the system that ensures automated market-making and liquidity management.

Can I earn passive income with both Radium and Radium CPMM?

Yes, absolutely! With Radium, you can earn rewards through staking and yield farming, while Radium CPMM rewards liquidity providers.

How secure are Radium and Radium CPMM?

Both are built on secure blockchain protocols. Radium uses Solana’s security features, while Radium CPMM relies on smart contract audits.

Which one should I invest in for long-term growth?

If you’re looking for a broad DeFi platform, Radium might be the way to go. However, if you’re interested in liquidity provision and market-making, Radium CPMM offers great potential.

Can Radium and Radium CPMM be used separately?

Not really! Radium CPMM is a core part of Radium. You can’t have the Radium experience without Radium CPMM running behind the scenes.

What makes Radium CPMM unique?

The Radium CPMM model is unique because it uses the constant product formula to ensure price stability and automated liquidity management.

How do I get started with Radium and Radium CPMM?

Simply use the Radium platform, where you can start swapping tokens, providing liquidity, and earning rewards. Radium CPMM will be the tool running everything in the background.

Read Also: Solana ETF in USA: What to Expect and Why It Matters!

Conclusion:

The difference between Radium and Radium CPMM crypto is quite simple, and that is the position of the two.

Raydium is your comprehensive DeFi destination for trading, staking, and much more, while Raydium CPMM is the powerhouse guiding the action as the facilitator of liquid and efficient trades.

Altogether, they make a highly effective system that actively reshapes the face of decentralized finance.

Therefore, for those who are interested in DeFi or have been investing in cryptocurrencies and are wondering what Radium and Radium CPMM are – this blog will provide you with basic knowledge of how these two components are interconnected and how they will make your DeFi experience even more profitable, faster, and more efficient.