Introduction

In this article, I will discuss “What is Arkham Intelligence, Step-by-step process on How to Use Arkham Intelligence and its Key Metrics to Predict the Market’s Next Move.

Table of Contents

Before diving into the detailed explanation of on-chain analysis, let me tell you that an article is already available on this topic. In that guide, I explained what on-chain analysis is and how you can conduct it using different cryptocurrency tools such as Glassnode.

Today’s on-chain analysis article will be slightly different, as many of you have been requesting a detailed article on this topic. In response to your comments, I have created this in-depth guide on on-chain analysis.

If you find this valuable, make sure to subscribe to the website by clicking the bell icon below and share it with your crypto-interested friends.

Additionally, if you have previously engaged in free crypto on-chain analysis and applied your assessments, then you have already been performing on-chain analysis without realizing it.

What is Arkham intelligence?

The primary goal of this Tool is straightforward: to observe ongoing market activities. By monitoring fund movements from major entities, you can anticipate potential market shifts.

You can track how many Bitcoins are being moved, and where they are being withdrawn from, and apply the same method to analyze various altcoins.

For example, if large funds are being moved into an exchange, it could signal upcoming selling pressure, while massive withdrawals might indicate a buying trend.

Arkham Intelligence enables you to trace transactions down to individual addresses. This is a significant advantage as it gives you granular data for deeper analysis.

For example, if some crypto influencer or exchange moves funds between their wallets without changing the asset, it usually means they’re just reorganizing their holdings rather than planning to sell.

And if they start converting those holdings into USDT or another stablecoin, that’s often a sign of selling pressure—it suggests they’re shifting towards stability, possibly in anticipation of market volatility.

On the other hand, when large amounts of USDT start flowing from cold wallets to exchanges, it’s usually a sign that traders are getting ready to buy. This kind of activity is generally seen as bullish since it indicates demand for cryptocurrencies is about to pick up.

Several other on-chain analysis tools can shift your market perspective to align more with how market makers view it. If you haven’t checked out the article on Glassnode charts yet, you can read it by clicking this link.

How to use Arkham Intelligence? Step-by-Step Guide

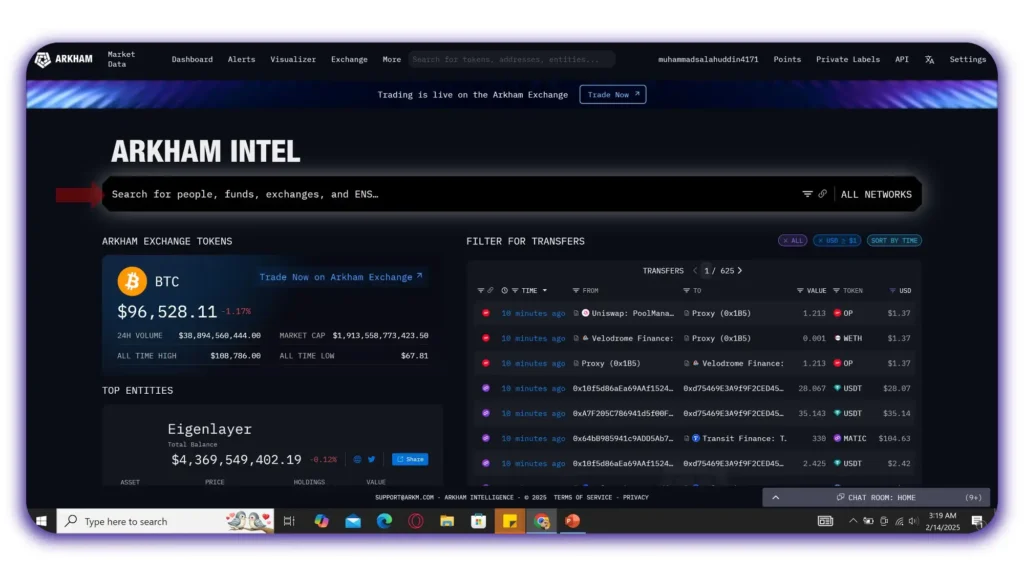

To start using Arkham Intelligence, simply open your browser and type ‘Arkham Intelligence.’ The official website will appear, and you just need to click on it. After clicking, the interface will load, giving you access to various analytical features.

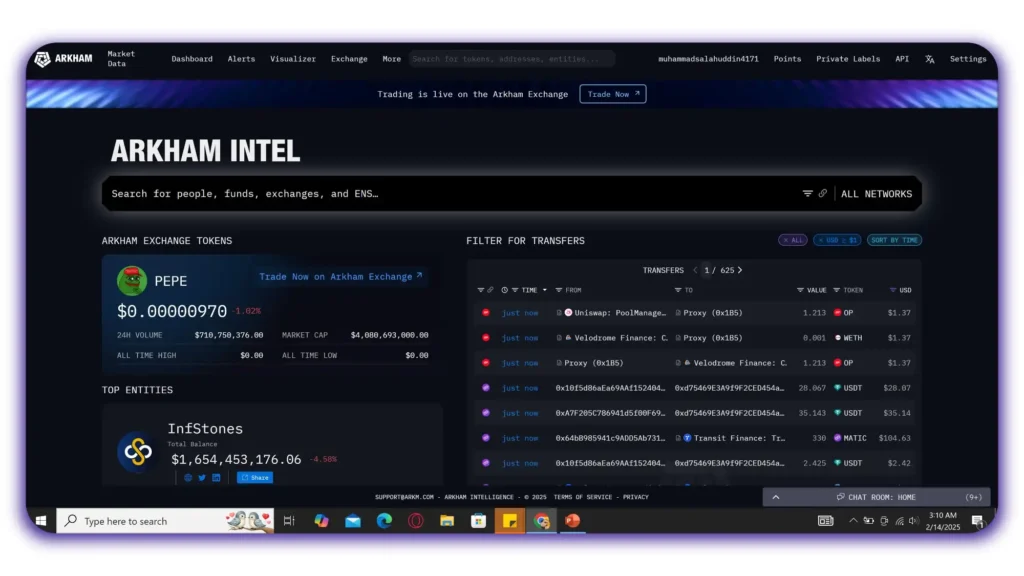

Upon accessing Arkham Intelligence, you will notice a ‘Launch Platform’ option. Click on it, and it will open in a new tab. The interface will display trending token pages and live transaction data.

Scrolling down, you will see insights into major entities’ holdings, indicating whether they are currently in profit or loss. Don’t be overwhelmed by the data—you will gain a clearer understanding as we proceed.

Feature 1: How to Search For a Specific Wallet?

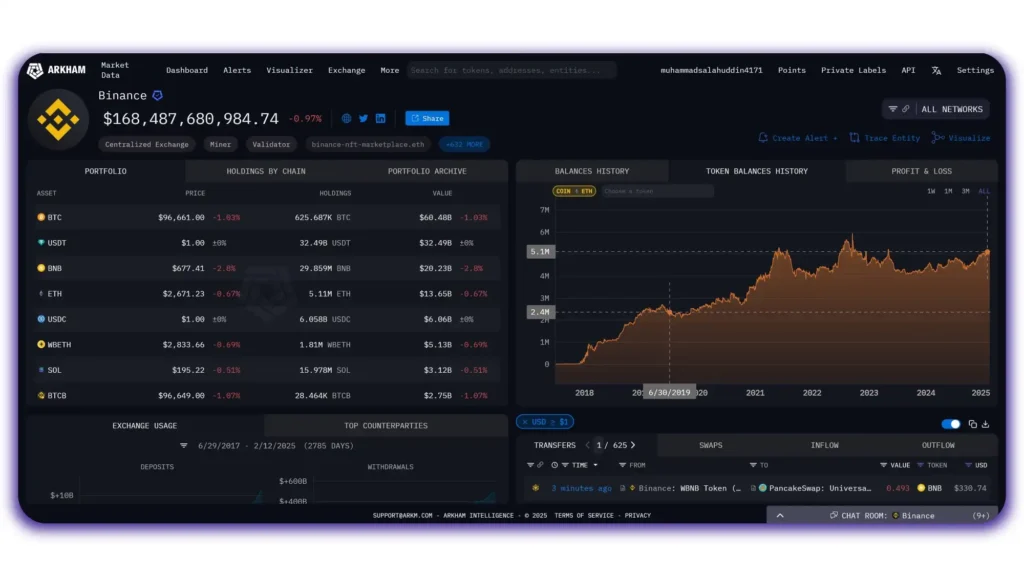

At the bottom of the Arkam Inel, there is a search bar. Here, you can enter a wallet address or name to view specific holdings. For instance, if you type ‘Binance,’ you will see data related to both Binance and Binance US. By selecting ‘Binance Global,’ you can access detailed asset holdings.

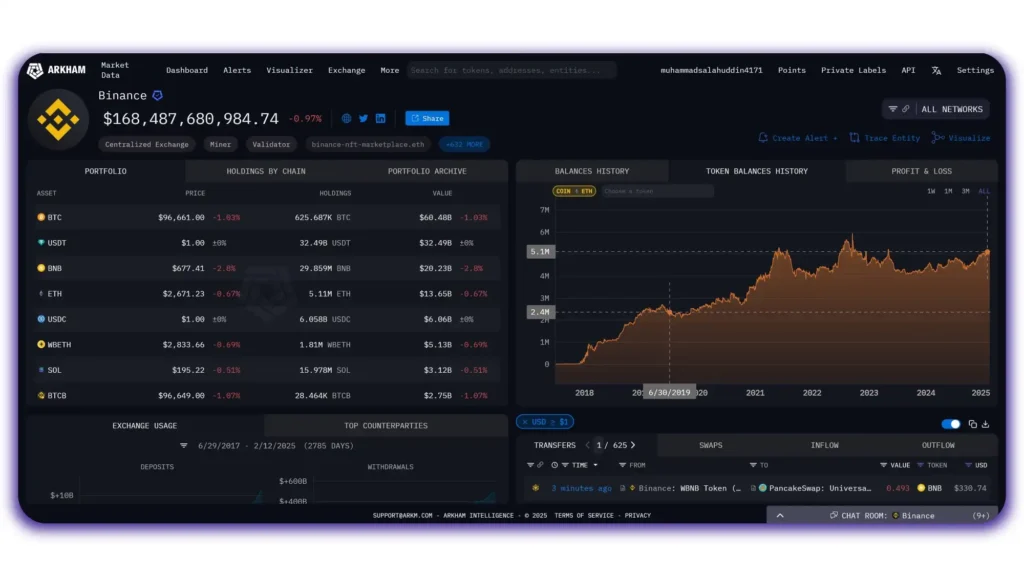

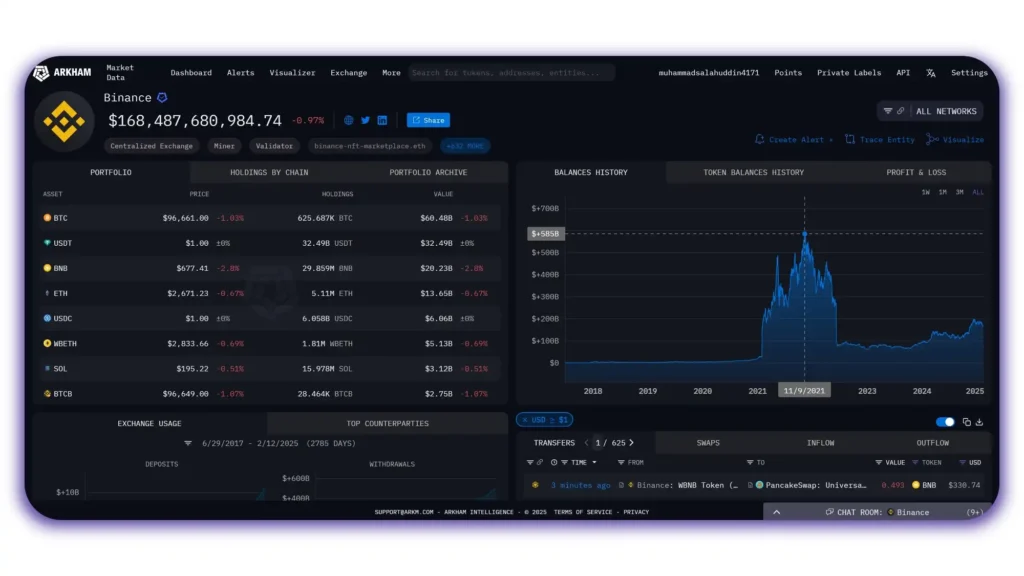

Currently, Binance holds over $169 billion in assets, including 647k Bitcoin with a total value of approximately $60.75 Billion, and also 29.895 million BNB, with a total value of approximately $20.71 billion. The recent increase in Binance’s valuation is due to market appreciation.

Beyond Binance’s holdings, you can also examine Bitcoin and other altcoins within their portfolio. If you are looking for potential altcoin investments, you can track what major exchanges and influencers are holding.

Pro-tip. By identifying a common low-cap coin present in multiple high-profile wallets, you can conduct further research and assess its potential. If you need a comprehensive guide on fundamental research, let me know, and I will create a separate video for you.

Feature 2: How to check Balance History and What is it:

On the right side of the interface, a chart displays the total asset valuation over time. This determines the total value of Assets held by an entity.

If you analyze historical data, you can observe how assets were valued during different market phases. For example, during the 2021 bull run, Binance’s asset value peaked at around $600 billion, while its current valuation stands at $169 billion and is steadily increasing.

Feature 3: What is Token Balance History and How to identify Accumulation pattern:

The interface remains the same as explained earlier. If you tap on ‘Token Balance History,’ you can observe the historical balance of a specific token associated with an exchange or an individual.

For example, in our case, Binance’s ETH holdings in 2019 stood at approximately 2.5 million ETH. And now in 2025, their holdings have increased to around 5.1 million ETH.

This type of on-chain analysis allows you to recognize trends—if a major entity is continuously accumulating a certain asset, it could indicate their confidence in its future price appreciation.“

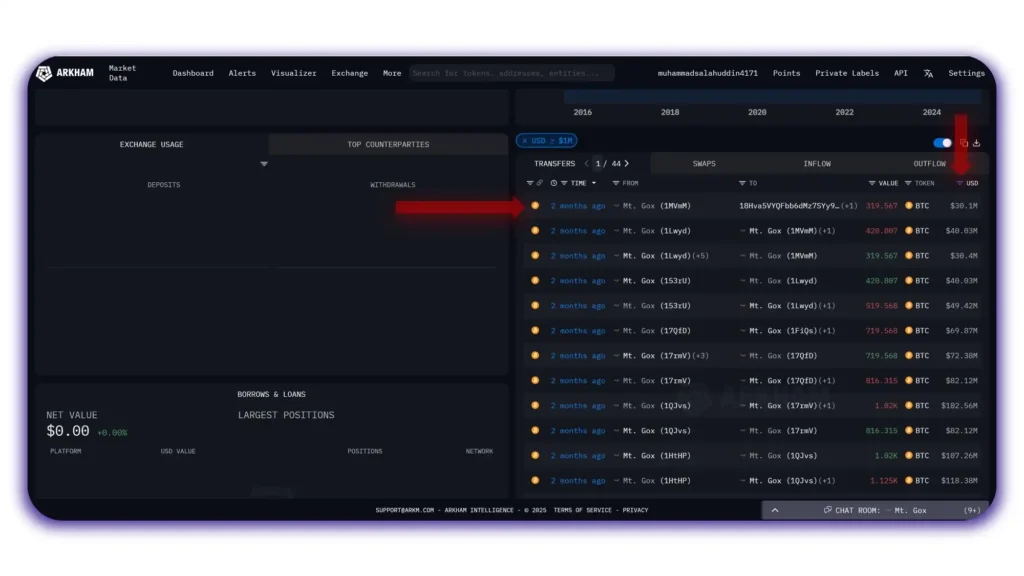

Feature 4: How to read Transaction Section: Mt. Gox transaction and its Impact on Market

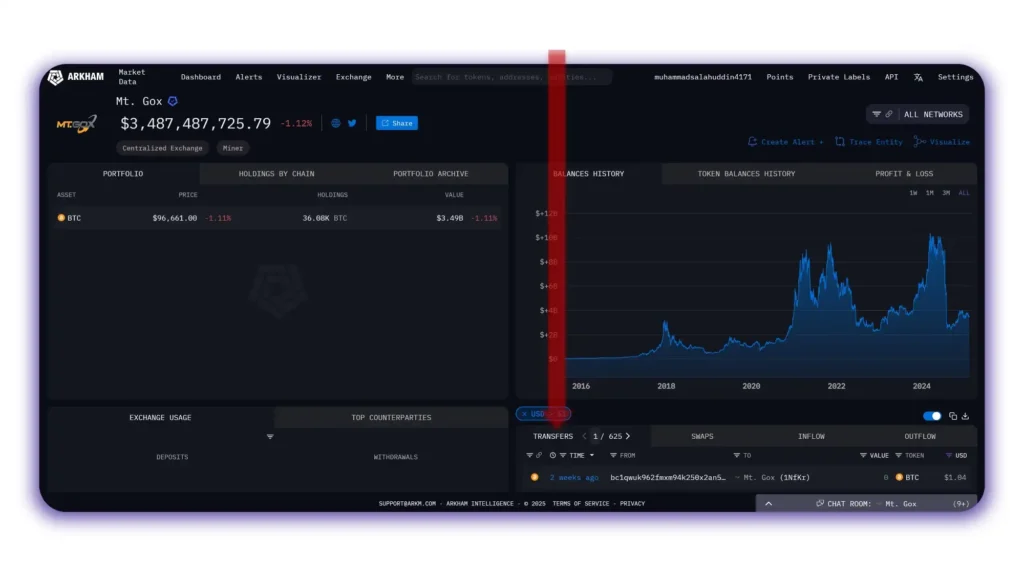

Moving down, you will find the ‘Transactions’ section—one of the most crucial parts of on-chain analysis.

Recently, you may have heard news about Mt. Gox transferring funds. With Arkham Intelligence, you can track where these funds are moving, how much has been transferred, and which wallets are involved.

The table displays ‘From’ and ‘To’ wallet addresses, token values, and transaction amounts.

One key insight from this data is understanding how exchanges handle fund transfers. Often, before transferring a large amount, a smaller test transaction is conducted to ensure smooth processing.

For instance, Mt. Gox initially transferred a small sum before moving billions of dollars, ensuring that no technical issues arose. Exchanges follow similar practices before moving substantial funds.

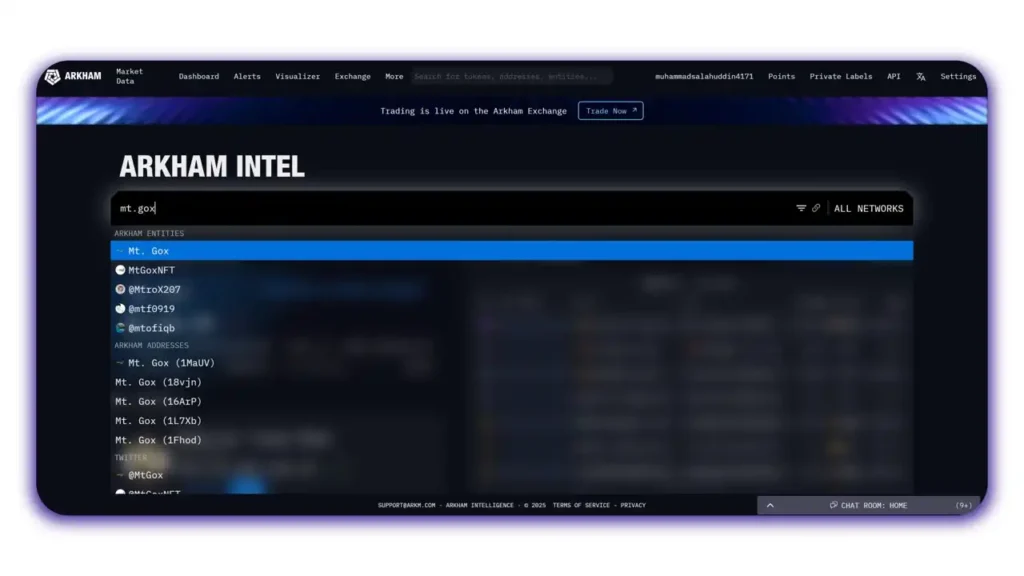

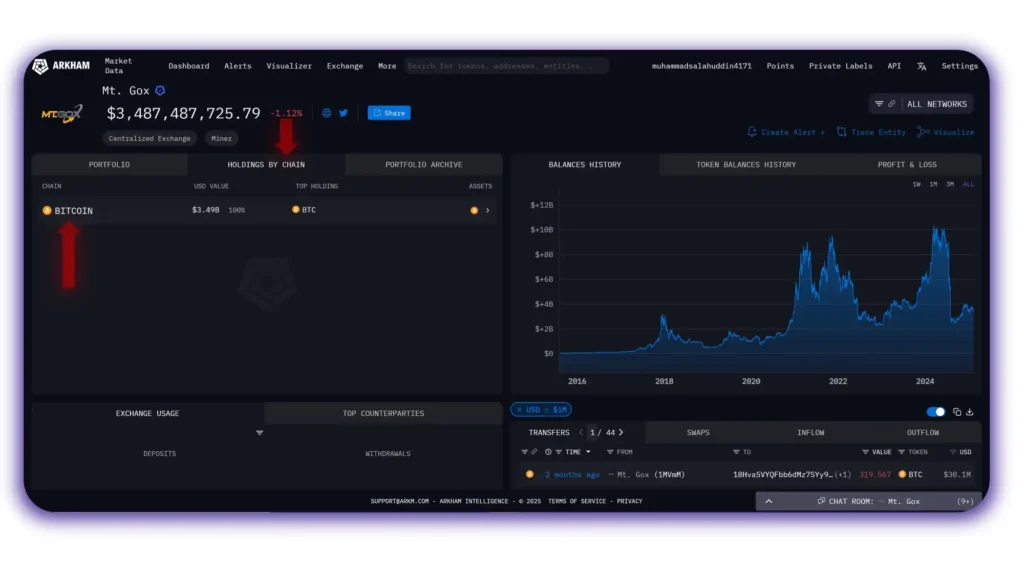

If you want to track Mt. Gox’s transactions, go to the top search bar and type ‘Mt. Gox.’ The first wallet result will display Mt. Gox’s holdings, which currently stand at $3.5 billion. For those unfamiliar, Mt. Gox was a major Japanese exchange that dominated the Bitcoin market in 2014.

Unfortunately, it was hacked, resulting in the loss of over 850,000 BTC. Despite shutting down, some funds were later recovered and are now being distributed to creditors. This is why Mt. Gox still holds a significant Bitcoin reserve worth $3.5 billion. When it announced to give back the funds it almost held a reserve of about $9.5 billion

If you click on ‘Holdings by Chain,’ on the top left side of the interface as shown in the picture below, you can see which blockchain assets are stored. Since Mt. Gox’s reserves are entirely in Bitcoin, the data will reflect this. However, for other wallets, you can analyze which blockchain networks their assets are spread across.

To analyze large transactions, click on the three-line menu next to USD and set a filter for transactions exceeding $1 million. This will highlight significant fund movements, such as a recent $30.1 million transfer from Mt. Gox’s address(1MVmM) to the address (18H6uUyAkxzM5gt9Rx7GAwnvNawqa….) as shown in the picture below. Tracking these transactions provides insights into potential market impacts.

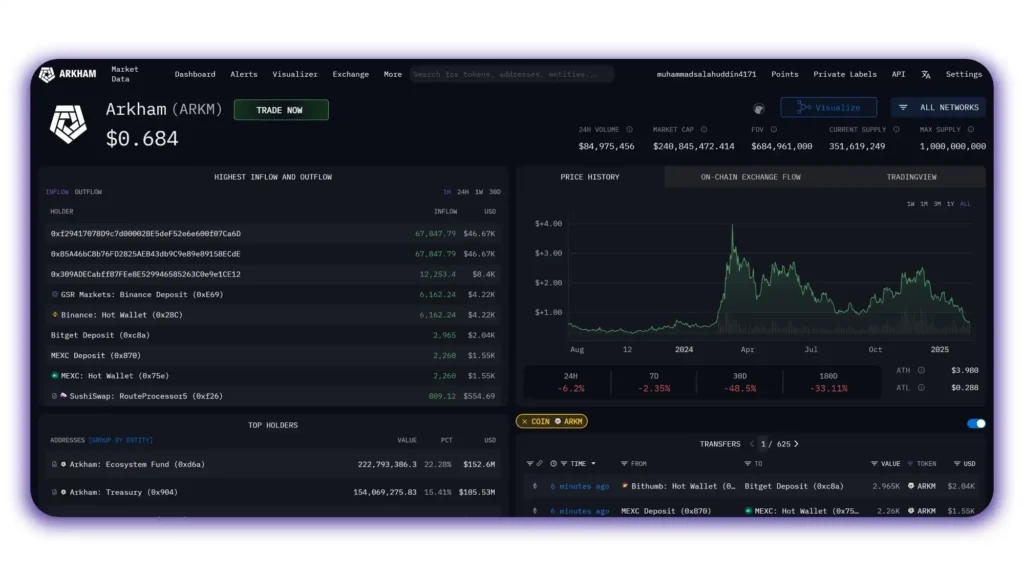

Arkham Intelligence Token (ARKM) and Market Relevance

let’s clarify one important point: if you search for ARKM on Binance or any other exchange, you will find various trading pairs. This indicates that ARKM is actively traded on exchanges.

Understanding a token’s utility is crucial before trading it. If a token lacks a solid use case, it is often labeled as a ‘shitcoin,’ whereas a token with real-world applications is considered an altcoin.

I am using Arkham as an example because whenever you trade it, you will find USDT pairs or other trading pairs available. This suggests that a legitimate project and team is backing the token, which increases its credibility.

When evaluating long-term performance, fundamental research is essential. If you are interested in learning how to study a coin’s fundamentals, let me know in the comments, and I will create a dedicated guide for you. But for now, let’s stay on topic and return to the analysis.

FAQs

What is Arkham Intelligence, and how does it help in crypto trading?

Arkham Intelligence is an on-chain analytics platform that allows users to track wallet transactions, monitor fund movements, and analyze exchange flows. It helps traders predict market trends by providing real-time data on large transactions and holdings.

How do I access and use Arkham Intelligence?

To use Arkham Intelligence, visit the official website and click on the ‘Launch Platform’ option. From there, you can explore trending token pages, live transaction data, and insights into major entities’ holdings.

What are the key features of Arkham Intelligence?

Arkham Intelligence provides tools to analyze transaction history, wallet balances, exchange fund flows, and large market movements. It also allows users to search for specific wallet addresses and filter transactions by size.

How can I track large transactions using Arkham Intelligence?

You can use the transaction filter to highlight fund movements exceeding $1 million. This helps identify whale activity, exchange deposits/withdrawals, and potential market shifts.

Can Arkham Intelligence predict market trends?

While it doesn’t predict directly, it provides valuable insights into buying and selling pressures. For example, large USDT inflows to exchanges may indicate upcoming buying activity, whereas significant BTC withdrawals may signal accumulation.

What is the ARKM token, and how is it used?

ARKM is the native token of Arkham Intelligence, used for platform functionalities. It is actively traded on major exchanges and plays a role in accessing premium analytics features.

Is Arkham Intelligence suitable for beginners?

Yes, but it requires some learning. Beginners can start by exploring wallet tracking and transaction monitoring, gradually incorporating deeper on-chain analysis techniques to improve their crypto trading strategies.

Conclusion

Many more in-depth features could be explored, but this overview gives you a strong foundation for using Arkham Intelligence to conduct on-chain analysis. Now, it’s your turn—go ahead, explore Arkham Intelligence, and observe how transactions unfold in real-time. This hands-on practice will engrain market insights into your subconscious, improving your decision-making in crypto trading.

Before concluding, let me remind you again—if you found this guide helpful, please comment below and share it with your friends who are interested in crypto. Creating these in-depth analyses requires significant effort, yet many viewers prefer sensationalized ‘30x coin’ content rather than practical knowledge.

Unlike those content, my goal is to provide you with real insights that you won’t find elsewhere. By applying these techniques, you will develop the ability to make independent, well-informed trading decisions.

See you in the next video, and if you have used my free trading insights, feel free to share your experience!”

3 thoughts on “How to Use Arkham Intelligence for On-Chain Analysis”