Introduction

Explore Privacy Coins Under $1 in 2024-2025: Affordable, anonymous cryptocurrencies like Verge, Pirate Chain, and Secret. Risks, rewards, and how to invest wisely.

Let’s be honest—privacy is becoming a luxury in today’s hyper-connected world. Every click, swipe, or transaction leaves a digital trail. That’s where privacy coins come in.

These cryptocurrencies are like the Swiss bank accounts of the digital age, letting you move money without Big Brother watching. But here’s the kicker: you don’t need deep pockets to get started.

Table of Contents

In 2025, the Low-cap privacy coins list including Pirate Chain (ARRR), and Dusk Network (DUSK) are flying under the radar, priced under $1, yet packing serious privacy tech. Let’s break them down—no jargon, no fluff—just straight talk.

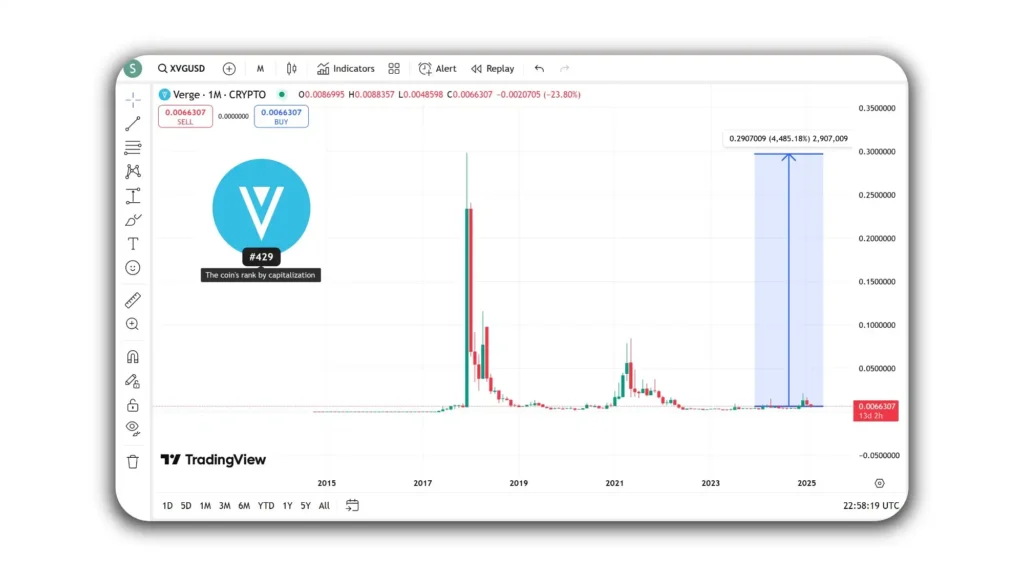

1. Verge (XVG) – $0.006

Market Cap: 109.7 million

All-Time High: 0.1808 (2018)

The Basics

Verge is like the “starter pack” of privacy coins. It’s cheap, fast, and easy to use. Instead of fancy math, it hides your IP address using Tor and I2P—the same tools activists use to dodge censorship. Think of it as a VPN for your crypto transactions.

Why It’s Interesting

- Speed: Sends cash faster than Venmo (seriously—5 seconds).

- Cheap Fees: A fraction of a penny per transaction.

- Real-World Use: Accepted by sites like TokenPay for buying gift cards or paying bills.

The Catch

Verge doesn’t hide your transaction amounts. If someone really wanted to snoop, they could trace your wallet activity. It’s privacy-lite, but for casual users, that’s enough.

Is It Legit?

Verge has been around since 2014—older than TikTok. Its dev team keeps rolling out updates, but it’s lost steam compared to newer rivals. Still, for under a penny, it’s a low-risk bet. Whitepaper and Website

2. Pirate Chain (ARRR) – $0.1780

Market Cap: 34.96 million

All-Time High: $8.6335 (2021)

The Basics

Pirate Chain is the Ocean’s Eleven of crypto—slick, stealthy, and all about anonymity. Every transaction uses zk-SNARKs, a tech that’s like a cryptographic invisibility cloak. Even Edward Snowden would nod in approval.

Why It’s Interesting

- Total Privacy: No leaks—sender, receiver, and amount are all buried.

- Community-Driven: No corporate overlords. Decisions are made by users, not suits.

- Themed Fun: Who doesn’t love pirates? The branding is quirky but memorable.

Is Pirate Chain a Good Investment?

The tech is rock-solid, but its future hinges on dodging legal crackdowns. Regulators are eyeing the best anonymous cryptocurrencies like ARRR, and major exchanges avoid it. If you’re okay with volatility, ARRR is a wildcard worth watching.

The Catch

Finding ARRR on major exchanges is like finding a unicorn. You’ll need to hunt on niche platforms like TradeOgre. Plus, regulators are eyeing privacy coins like hawks.

Is It Legit?

The tech is rock-solid, but its future hinges on dodging legal crackdowns. If you’re okay with volatility, ARRR is a wildcard worth watching. Website & Whitepaper

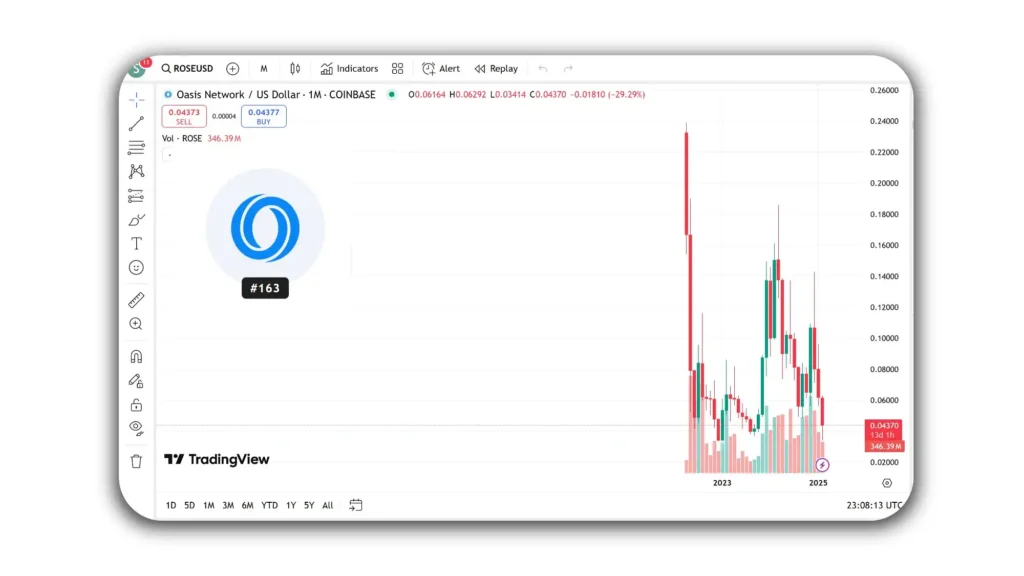

3. Oasis Network (ROSE) – $0.04385

Market Cap: 309.5 million

All-Time High: $0.5657 (2022)

The Basics

Oasis Network is the privacy guardian for Web3. It combines confidential smart contracts with a focus on data sovereignty, allowing users to control and monetize their personal data securely.

Why It’s Interesting

- Confidential Compute: Uses secure enclaves (TEEs) to protect data during processing.

- Data Tokenization: Turn sensitive info (e.g., medical records) into private, tradable assets.

- Eco-Friendly: Low-energy consensus mechanism (Proof-of-Stake).

The Catch

- Niche Focus: Targets enterprises and developers, not casual users.

- Adoption Hurdles: Still building partnerships in the healthcare and AI sectors.

Legitimacy Check

- Backed by A16Z: Andreessen Horowitz and Binance Labs are key investors.

- Partnerships: Collaborates with BMW, Genetica, and Meta’s AI research team.

- Regulatory Edge: Compliant frameworks make it palatable for institutions.

Website and Whitepaper

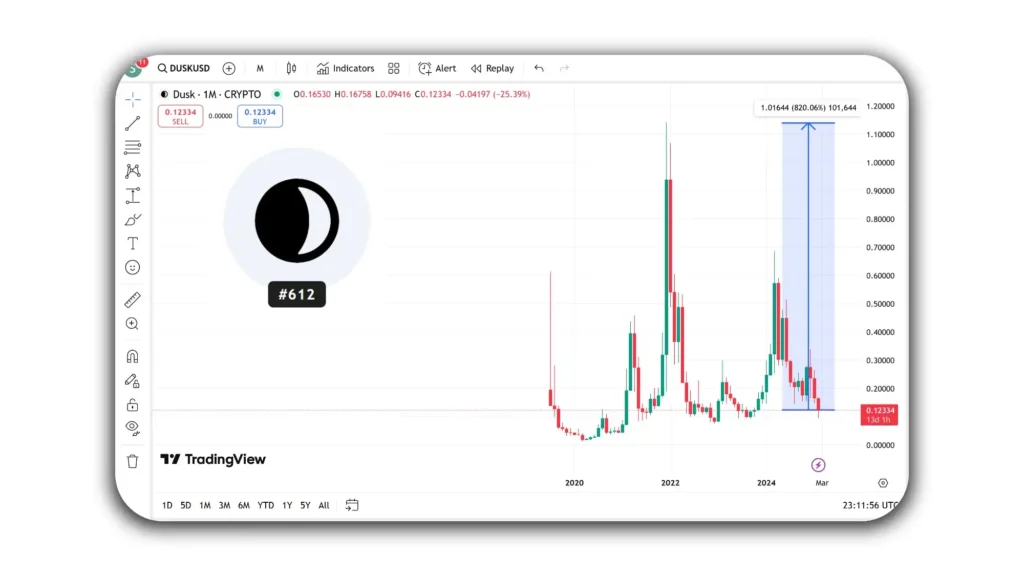

4. Dusk Network (DUSK) – $0.1234

Market Cap: 59.43 million

All-Time High: $0.96 (2021)

The Basics

Dusk is where privacy meets Wall Street. It’s built for confidential DeFi—think private stock trading or real estate deals on the blockchain. No prying eyes, just smooth, encrypted transactions.

Why It’s Interesting

- Regulation-Friendly: This plays nicely with EU laws, so institutions won’t shy away.

- Cheap & Fast: Gas fees are a nickel, and trades settle in 10 seconds.

- Real-World Use: Pilots with banks for tokenizing assets.

The Catch

Dusk’s success depends on big players adopting it. If banks shrug, DUSK could flatline.

Is It Legit?

Backed by Binance Labs and packed with patents, Dusk feels less “crypto cowboy” and more “serious startup.” But its tiny market cap means wild price swings.

Website and Whitepaper

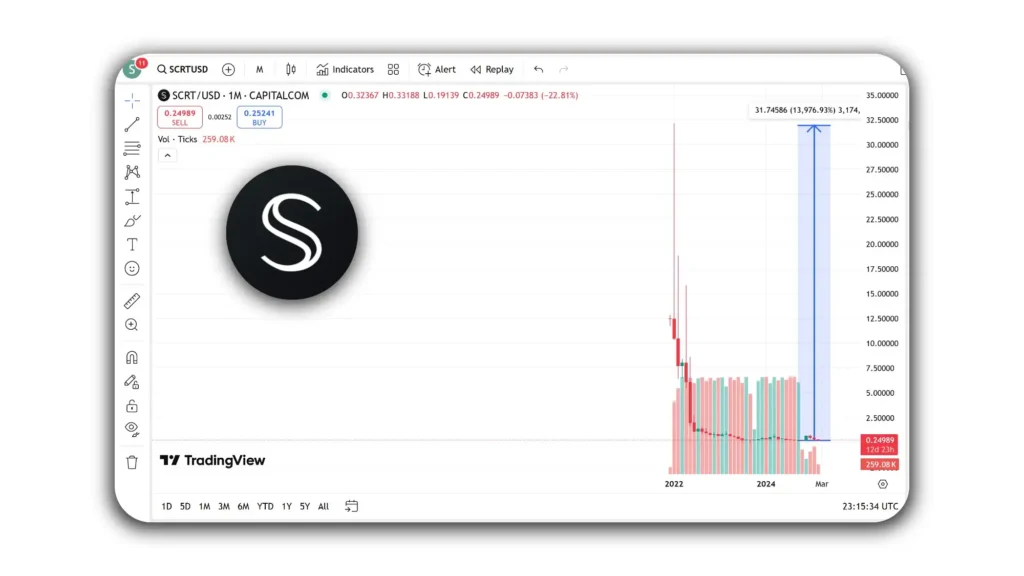

5. Secret (SCRT) – $0.2533

Market Cap: 76.29 million

All-Time High: $9.5274 (2022)

The Basics

The secret is the Swiss Army knife of privacy. It encrypts everything—smart contracts, data, even NFTs.

Why It’s Interesting

- Secret Contracts: Code and data are encrypted. Even developers can’t peek.

- Real-World Use: Private healthcare records, anonymous voting, encrypted social media.

- Interoperability: Works with Ethereum, Binance Chain, and more.

The Catch

- Complexity: Requires coding skills to build dApps.

- Regulatory Target: Like all privacy coins, governments are watching.

Legitimacy Check

- Backed by Heavyweights: Arrington Capital, HashKey, and Binance.

- Audited: Code reviewed by top security firms.

- Adoption: Used by projects like Shade Protocol (private stablecoins).

Website and Whitepaper

Read Also: Deepseek Crypto Crash: The Prospects of Decentralized Innovation, AI, and Crypto

Risks You Can’t Ignore

Let’s get real: privacy coins aren’t for the faint of heart. While they promise financial freedom, they come with pitfalls that could sink your portfolio faster than a torpedoed pirate ship. Here’s what keeps investors awake at night:

1. Regulators Hate Privacy

Governments worldwide are cracking down on anonymity-focused crypto. Japan and France have already banned exchanges from listing privacy coins like ARRR or SCRT, and others are following suit.

Imagine your $0.05 coin getting delisted overnight—its value evaporating because it’s suddenly untradeable. Even projects with bulletproof tech can’t outrun a regulator’s red pen.

2. Tech Glitches = Public Drama

Privacy tools like zk-SNARKs (used by Pirate Chain) or Secret’s encrypted smart contracts sound invincible—until they’re not. A single coding flaw could turn your “untraceable” transactions into an open book.

Remember the $320 million Wormhole hack in 2022? A tiny bug caused that disaster. Now imagine a similar flaw in a privacy protocol.

Your secret stash? Front-page news. And good luck suing anyone—decentralized projects don’t have CEOs to blame.

3. Liquidity Traps

Privacy coins like ARRR or DUSK often trade on obscure platforms with paper-thin order books. When the market crashes, you’ll be stuck holding a bag nobody wants.

Picture Bitcoin dropping 20%, and everyone panic-sells. But for low-cap coins, there are no buyers—just a frozen market and a sinking feeling. Your investment could vanish not because the project failed, but because there’s no one to sell to.

Disclaimer

Not Financial Advice this article is for educational purposes only. Always conduct your own research (DYOR) before investing. Cryptocurrencies, especially privacy coins, are highly volatile and subject to regulatory risks. Never invest more than you can afford to lose.

No Guarantees: Past performance ≠ future results. Prices can crash or soar unpredictably.

Regulatory Risks: Governments may ban privacy coins (e.g., Japan, France).

Tech Risks: Bugs in encryption or smart contracts could wipe out value.

Final Thoughts

Let’s cut through the hype: privacy coins under $1 are high-risk, high-reward. They’re not for your grandma’s retirement fund. But if you’re tired of banks and Big Tech tracking every dollar, these coins are digital rebellion in your pocket.

Verge is the easy choice, Pirate Chain is the purist’s pick, Horizen is the builder’s toolkit, and Dusk is the institutional dark horse. Just remember—never invest more than you’d lose in a Vegas poker game.

Pro Tip: Use a hardware wallet (like Ledger) and avoid bragging about your holdings online. Privacy starts with you. Only invest what you can afford to lose

1 thought on “Top 5 Privacy Coins Under $1 in 2024-2025: High-Risk or High-Reward?”