Can Scammers Use Cryptocurrency to Steal Your Social Security Number SSN? How to Spot and Prevent It

What is up, Internet Explorer? That nine-digit number you have stored in your brain (or written down on a Post-It note somewhere)… Do it! I am referring to your Social Security Number, The SSN.

The scaffolding of all things official in America — plastic money, lines of credit, the basic kit, and caboodle to prove you exist on planet Uncle Sam.

But guess what? Scammers love your SSN too! They found a new playground to exploit. Cryptocurrency In this series, we will explore the wild world of digital scams and how Scammers Use Cryptocurrency to Steal Your Social Security Number (SSN).

Spoiler alert: It is dark, but I will keep it readable.

Table of Contents

Introduction: Relationship Between Crypto & SSNs

The SSN: Your Identity’s Favorite Hoodie

Think of your SSN as you think of your favorite hoodie, it fits only you and is very comfortable! Now, picture someone breaking into your closet and stealing the clothes in question to then go around town walking up a tab using your credit.

Creepy, right? That’s kind of what it feels like when scammers have your SSN.

They have used it to establish lines of credit, secure loans, and sometimes file phony tax returns. But now you see, they have taken their scam craft to the next level with cryptocurrency assistance.

Crypto: The Wild West of the Digital World

In many ways, cryptocurrency is the digital analog of gold rush towns: thrilling, lawless, and colorful. It is the place where you can become a millionaire (or lose it) in seconds.

That said, just like those old Westerns: where there is gold to be found- bandits aplenty. The bandits in this case are scammers who have found a way to harness your SSN into the world of crypto.

How Can Scammers Use Cryptocurrency to Steal Your Social Security Number SSN?

So, how exactly does an SSN end up tangled in the web of cryptocurrency? Let’s break it down:

Identity Theft 2.0

One, some scammer gets your SSN (most likely from one of all those prevalent data breaches y’all heard about but tried to ignore), and then they turn that into a phony person.

This new identity isn’t simply for opening a credit card — oh no, they’re signing into apps to set up their wallets and making trades on your behalf.

Crypto exchanges are not as discerning about who they take in, which is exactly what scammers need to fly under the radar.

Crypto Phishing: The Email You Shouldn’t Have Opened

Picture this: you’re sipping your morning coffee when you get an email from what looks like your favorite crypto exchange.

It says there’s an urgent issue with your account. Panic sets in, and you click the link (big mistake).

Suddenly, your crypto wallet is empty. Scammers often use your SSN to gain access to other personal accounts, including your email, and then launch these sneaky phishing attacks. If it smells fishy, it’s probably phishing.

The Dark Web Marketplace: Where SSNs Are Sold for Bitcoin

Ever heard of the dark web? It is the center of Town where all the shady stuff happens.

The SSNs are traded like baseball cards and are usually sold in exchange for cryptocurrencies. With those SSNs now in the hands of scammers leveraged the information to report these as stolen or lost and continued work committing fraud with them because the digital trail for authorized users went cold.

The worst part is that it plays out like one of those bad spy movies, only this time there are real people’s lives on the line.

I’m not blaming cryptocurrency itself—anything can be used for good or bad depending on a person’s intentions. Check out our article on ‘Cryptocurrency is a Bubble‘ to understand the authenticity of cryptocurrency.

What You Can Do: Because Nobody Wants to Be a Victim

So now that I have sufficiently freaked you out, the question is: what can you do about it?

Do not share your SSN with anybody unnecessarily.

Check twice before clicking on an email or message, even if it only was collaterally different. If it is too urgent or sounds too perfect call – it is fraud.

Lastly, you could always sign up for a credit monitoring service too because an ounce of prevention is worth a pound of cure or a pound of BTC in this case.

How To Check if your Social Security number was stolen?

Alright, let’s face it—finding out your Social Security Number (SSN) might have been stolen can be downright scary. But don’t worry, I’ve got your back. Here’s a simple, step-by-step guide to help you check if your SSN has been compromised and what you can do about it. We’ll be using and I’ll walk you through every step of the way.

Sure, no one likes hearing their Social Security Number (SSN) could have been stolen! Fortunately for you, I have your back.

By following a few simple steps you can determine if your SSN has been breached and how to handle the situation.

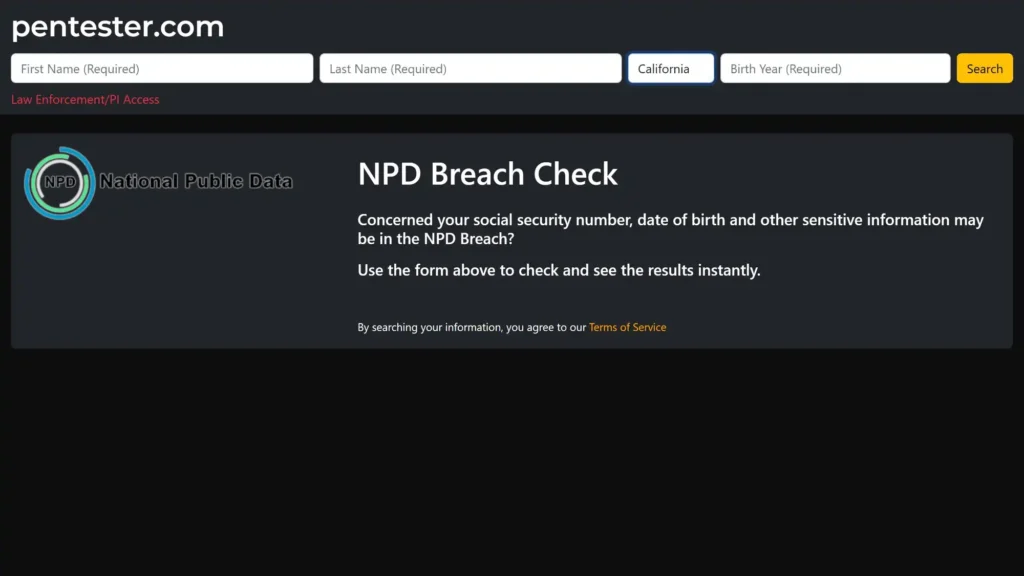

We will be utilizing a handy tool called the NPD Checker at npd.pentester.com and I will help you through every step of the process.

Step 1: Head Over to the NPD Checker Website

First things first, you’ll want to visit the NPD (National Personal Data) Checker website. This site is your go-to for checking if your data, including your SSN, has been caught up in any data breaches. I know it’s not the most fun thing to think about, but knowing is half the battle, right?

Step 2: Enter Your SSN or Other Personal Info

Once you’re on the site, you’ll see a search bar. This is where the magic happens—or rather, the crucial check.

Simply type in your name or any other personal info like your state or birth year. This will help you see if your data has been involved in any known breaches.

Important: I care about your safety, so make sure you’re on the right site (look for that “https” in the URL) before entering anything sensitive.

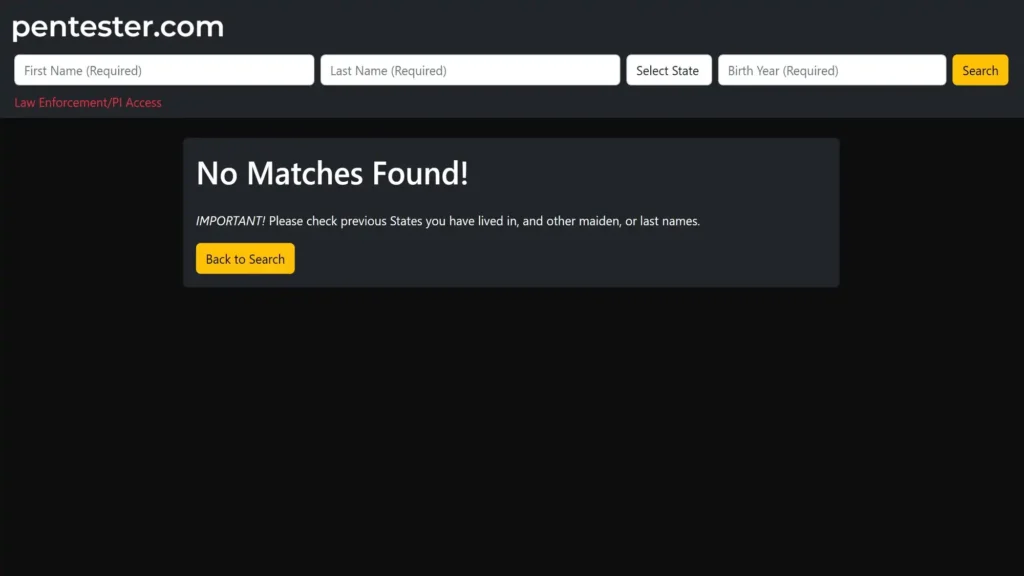

Step 3: Review What You Find

After hitting that “Search” button, the site will do its thing and check if your SSN has been compromised.

If it shows “no match found,” congratulations—you’ve dodged the breach this time! But remember, this doesn’t mean you are safe from the scammers. Do not worry I will tell you how to be safe from it just read the complete blog post.

If it has, you’ll get the details—like when and where it happened, and what info was leaked. This might feel overwhelming, but remember, this is just the first step in taking back control.

What to Do Next: Freeze Your Credit

It’s one of those gut-wrenching moments that leaves you feeling violated and worried. But hey, I’m here to help you navigate through it.

When your credit card is stolen, the first thing you might think about is calling your bank. Good move! But there’s another critical step that’s often overlooked:

Freezing your credit with all three major credit bureaus—Equifax, TransUnion, and Experian.

For example, if you freeze your credit reports (a process I describe in detail here) then it is like signaling to would-be identity thieves that there’s an impenetrable “Do Not Enter” sign on your credit report which makes them very unlikely to try opening new lines of credit because they will know the lines’ chances for approval are next-to-nil.

Here’s Why This Step Matters

Picture the criminal armed with your stolen card and identity attempting to open a new line of credit, purchase an automobile, or get financed for a house.

The freeze means they will hit a wall every time. You’ve shut the door on their secret agenda, and you have them where you want them!

Contact Information for Credit Bureaus to Freeze Your Credit and Protect Yourself

Contact Information for the Credit Bureaus:

Let’s make it easy for you to take action right now. Here’s the contact info for each bureau:

- Equifax:

- Phone: 1-800-685-1111

- Website: equifax.com

- TransUnion:

- Phone: 1-888-909-8872

- Website: transunion.com

- Experian:

- Phone: 1-888-397-3742

- Website: experian.com

All it takes is a call or a visit to their websites, and you can freeze your credit within minutes. Trust me, it’s worth the effort to protect yourself from potential identity theft.

The Only Downside: Unfreezing for New Credit

Well, I am one for blunt and so here is the single annoyance. Freezing your credit locks it down tighter than a tick — nobody, not even you can get any new line of extended credit until that freeze has thawed.

So, if you decide to apply for a new credit card, car loan, or mortgage, you’ll need to temporarily lift the freeze with all three bureaus.

Here is the catch: thawing your credit is just as simple. Yes, it is an inconvenience but do you not want to know that your credit is safe and sound?

Why I Care About You Taking This Step

I know, not the most fun topic but it is important to your financial security. If your card is ever stolen I want you to feel as empowered as possible.

One of the most powerful forms of protection is to freeze your credit, and I want you to have all the resources necessary to do just that.

If you think your card was stolen—or if you want to be preemptive about this—decompress, call customer service, and put that freeze in place. Your future you will be grateful!

Conclusion: Stay Safe, Stay Informed, and Don’t Let Scammers Win

Hello Cyber Freind I realize that discussing SSN scams and cryptocurrency is not as glamorous, but believe me – in this digital world we live in, it’s incredibly important to protect yourself.

Here’s a quick rundown of what you’ll find in this blog and why sticking with it is worth every minute.

By reading this blog from start to finish, you’ll uncover:

- The Sneaky Ways Scammers Exploit Your SSN:

We’ll break down how these digital bandits are using your SSN to commit fraud in the wild world of cryptocurrency. From creating fake identities to pulling off crypto phishing scams, you’ll get the lowdown on how your information can be misused.

- Understanding the Crypto Frontier:

Learn why cryptocurrency is the new playground for scammers and how your SSN might be the key they’re using to unlock this digital treasure chest. It’s like a high-stakes game of hide and seek, and you’re the prize!

- How to Check If Your SSN Has Been Compromised:

I’ll guide you through a simple, step-by-step process using the NPD Checker at npd.pentester.com. With this tool, you’ll know exactly if your SSN has been part of a data breach and what to do next.

- What Actions to Take If Your SSN Is Compromised:

From freezing your credit to avoiding phishing scams, you’ll get actionable advice on safeguarding yourself. I’ll show you how to put up a strong defense and keep those pesky scammers at bay.

- Practical Tips and Contact Info for Credit Bureaus:

Finally, you’ll find all the essential contact information for Equifax, TransUnion, and Experian, along with a straightforward guide on how to freeze your credit. It’s like having a financial safety net right at your fingertips.

Reminder: this blog is not just a list of tips but your very own lantern-in-the-dark for going through the whirlpools denoted by SSN fraud and cryptocurrency scams. I do actually want you to be safe, and reading this knowledge is a great step for your protection.

Grab a coffee, sit back, and let me show you how to beat them at their own game. That peace of mind is worth it and I am here to help you every step!

FAQs

What’s the worst that can happen if someone gets your SSN?

A thief who steals your SSN can go on to steal decades of work from you in a matter of months, creating unauthorized credit accounts and loans in your name that quickly balloon into defaulting bills.

They may also attempt to file a fraudulent tax return in your name, damage your credit score, or even sell off the SSN on the dark web so that it can be further exploited.

The aftermath is having to do an endless amount of paperwork and phone calls to get things back in line so make sure you keep a close eye on yourself and take action quickly!

How to check if your social security number has been used?

To check if your SSN has been used without your permission, visit a trusted data breach checker like NPD Checker, enter personal details, and review the results for any signs of compromise.

If your SSN shows up, it’s crucial to act swiftly by contacting credit bureaus to freeze your credit and prevent further misuse. This quick check can help you catch potential issues early and safeguard your personal information.

How are scammers using my SSN to exploit cryptocurrency?

Scammers use your SSN to create fake identities and access cryptocurrency platforms under your name. They might use this stolen identity to trade cryptocurrencies, commit fraud, or even sell your SSN on the dark web. With crypto exchanges often less stringent about user verification, scammers can slip through the cracks more easily.

What is the “dark web,” and how does it relate to my SSN?

The dark web is a part of the internet that’s not indexed by traditional search engines and is often used for illegal activities. Scammers can sell stolen SSNs for cryptocurrencies on these dark web marketplaces, making it easier for them to commit fraud and escape detection.

Why is freezing my credit important if my SSN is stolen?

Freezing your credit is crucial because it blocks any new credit accounts from being opened in your name, which can prevent scammers from using your SSN to commit fraud. While it may be a bit inconvenient to unfreeze your credit when applying for new credit, it’s a vital step in safeguarding your financial security.

How do I contact the credit bureaus to freeze my credit?

Here’s how you can contact each bureau:

- Equifax: Phone: 1-800-685-1111 | Website: equifax.com

- TransUnion: Phone: 1-888-909-8872 | Website: transunion.com

- Experian: Phone: 1-888-397-3742 | Website: experian.com

2 Responses