As a newbie to crypto, I was constantly hearing terms like “minting”, “burning”, and “minting”. No one really explained to me what these terms meant or, more importantly, how they affected the value of tokens. These two mechanisms are what can make or ruin a crypto project. Let’s examine token burning and token minting. What are they, how do they work, and which has the greater impact?

Why should you care about token burning and minting?

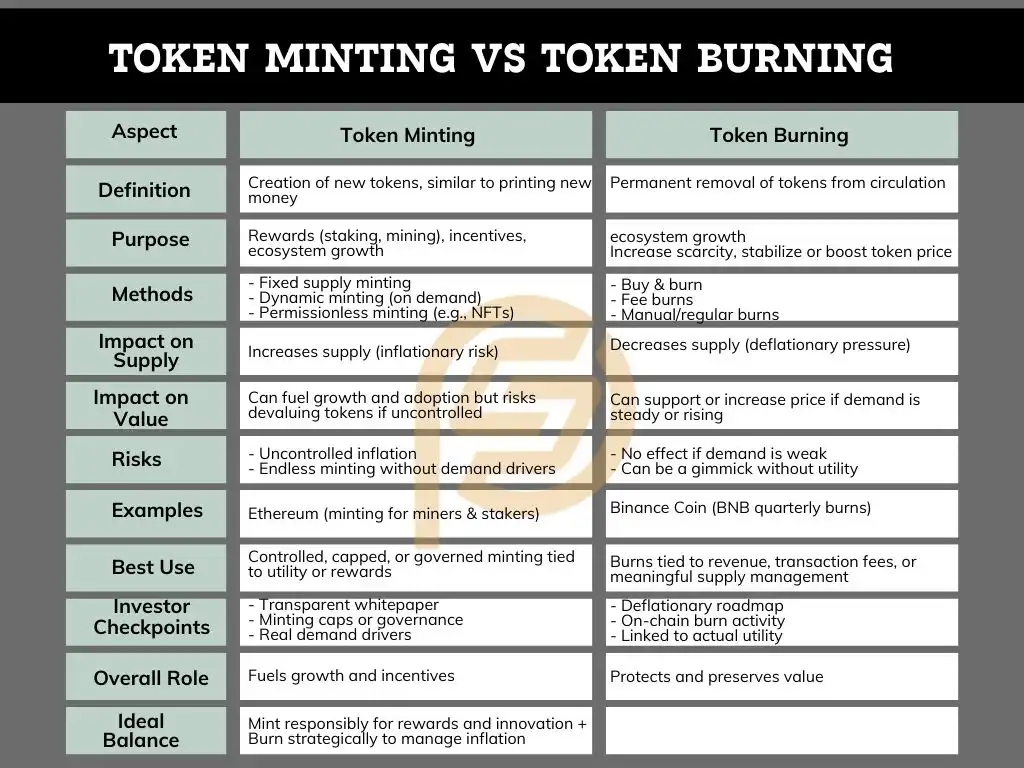

The yin-and-yang of cryptoeconomics is token burning and minting. The first removes tokens (burning) and the second creates them (minting). Both have a profound impact on supply, demand and price.

- Token minting is a process for creating new tokens. Imagine it as if you were printing more money within the traditional financial system.

- Burning Tokens is exactly the opposite. It’s when tokens have been permanently removed from circulation.

They are not just technical processes. These processes directly impact scarcity, inflation and investor confidence. It’s important to know when, how and why each strategy is used.

Does Token Minting Lead to Growth or Inflation

It’s considered to be minting when a new coin is created for stake rewards, platform incentives or ecosystem expansion.

Different types of minting exist:

- Minting with a Fixed Supply: Tokens are produced in advance and distributed over a period of time.

- Dynamic minting: Tokens can be minted on demand, typically to support stakes or DeFi rewards.

- Permissionless Mining: Common for NFTs and certain Layer-1 protocols. Users can mint their tokens according to rules set in a smart contract.

What are the benefits? The upside? What’s the downside? It can lead to inflation if it is not controlled. This can cause token values to plummet. The whitepaper of a project is always a good place to check whether minting is capped or governed with transparent rules.

Projects such as Ethereum (before merging) used to mint ETH to pay their miners. Proof-of-stake still mints ETH, but it does so much less. This shift was critical in controlling inflation.

How Token Burning Works: Scarcity Equals Value

Token burning is one way to reduce supply. This is often done with the intention of increasing scarcity and, therefore, supporting the token’s price. Price usually increases when demand is constant or rising and supply is shrinking. This is basic economics.

Popular burn methods

- Buy and burn: Project purchases tokens on the market to be burned.

- Fee Burn: A part of the transaction fees is automatically burned.

- Manual Burns Teams regularly burn tokens as part of tokenomics.

The burning of a cryptocurrency is viewed as a powerful deflationary tool, particularly in oversaturated markets. Binance Coin (BNB), which is famous for its quarterly burns, has been a major reason behind the long-term support of its price.

Nevertheless, burning tokens does not guarantee a value increase. Burning alone will not save the price if demand is low.

Read our basic topic on Crypto Burning and minting here

Minting vs Burning: What Matters More?

It’s not a matter of which is better. Balance is the key.

Burning can protect value. Burning can preserve value. When either of these is used in the wrong way, they can backfire.

I stay away from projects that continue to mint tokens without a deflationary balance. I don’t like projects that mint tokens endlessly without any real demand drivers. Look out for:

- A controlled minting strategy (with caps or Governance)

- A deflationary road map (burns tied directly to revenue or usage)

- Whitepaper on supply management that is transparent and clear

The token economy is healthy when minting supports innovation and burning prices.

Summary:

- Token production = Minting Fuels growth and incentives. Risk: inflation.

- Burning = Token destruction. Boosts scarcity. Risk: ineffective if there is no demand.

- Ideal model: Projects which mint money for rewards or utility but burn it to control inflation.

FAQs

Q. Is it always a good idea to burn tokens?

A: No. Only if there is a demand for the product will burning help. It’s a gimmick otherwise.

Can a coin be minted as well as burned?

A: Absolutely. A lot of tokens are used to balance the supply and demand.

Q. Where can I check if my token is burning or minting?

A: Check out the tokenomics section of the whitepaper or any on-chain activity, such as Etherscan.

Q: Does minting imply that a project will be inflationary?

A: No, not always. It depends on how you control the rate.

Final Thoughts

You’re blind if you invest in crypto without knowing how supply is managed. I view minting and burning as vital metrics for any token. They show how serious a project is about its economic design.

Before I invest, what should I consider? Do they mint responsibly? Are they burning in a meaningful way? These answers will tell you much more than any marketing campaign about a particular project.

Visit our Facebook page, and connect us via LinkedIn account